Checkout

List of endpoints

| Description | Endpoint |

|---|---|

|

Creating a Checkout Session |

POST /checkout/sessions

|

|

Confirming a Checkout Session |

POST/checkout/sessions/{ID}/confirm

|

What is a Checkout Session?

|

How would you like to pay?

Pay full Amount

Pay now

Pay in Installments

Start installment plan

|

A Checkout Session is the basis for displaying a form to your payer on your website. The goal of a Checkout Session is to collect the payer's information (name, address, etc.) and the payment information (card or bank account details). There are different forms you can display depending on your use case

|

Types of Checkout Sessions

Checkout for Self-Managed Recurring Payments

Checkout for Self-Managed Recurring Payments

What are Recurring Payments?

Recurring payments are payments that charge the same card or bank account multiple times.

The payer agrees to the plan for the recurring payments (for example multiple installments or an ongoing subscription), and allows their card or bank account information being stored for future payments. This means the future payments can be charged without the payer being present.

What are Self-Managed Recurring Payments?

With self-managed recurring payments, you define the plans yourself. You have complete freedom, for example regarding the number of installments and when payments are made.

Since Flywire doesn't know your settings, you have to manually initiate each payment for those plans yourself.

You also have to send mandatory emails to your payers that inform them about the recurring payments.

Available payment methods:

-

Card

-

Direct debit

Which direct debit schemes are supported?

Which direct debit schemes are supported?

Supported direct debit schemes

SEPA SEPA (Single Euro Payments Area) direct debit is a payment system that makes payments in Europe easier and cheaper. SEPA allows you to collect payments in all countries that follow the SEPA scheme (36 countries in the Eurozone). The currency for all SEPA direct debits is Euros.

BACS BACS (Bankers' Automated Clearing System) is a network of banks and building societies that participate in the BACS payments scheme. BACS payments are made in GBP and are only available in the UK. BACS payments are one of the most common bank-to-bank transfers in the UK.

EFT Canada EFT ("Electronic Funds Transfer") Canada is the most common direct debit scheme for payments in Canada. Flywire uses the third-party implementation Plaid to connect your payers to their bank accounts for EFT Canada.

ACH ACH ("Automated Clearing House") is an electronic network used in the United States of America for processing financial transactions. The ACH system is designed for domestic transactions within the United States, which means the currency for ACH payments is USD.

Available forms:

|

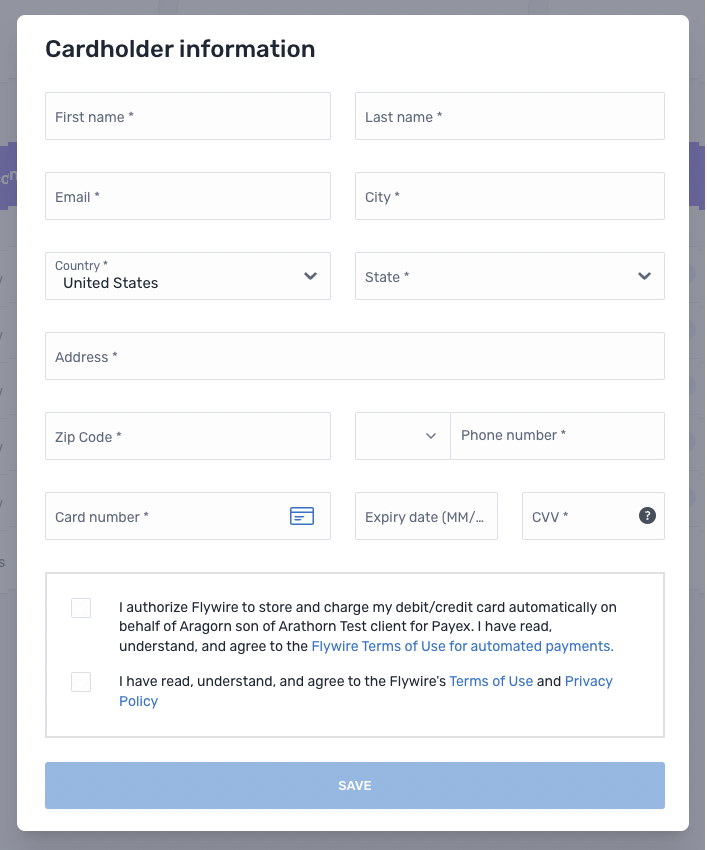

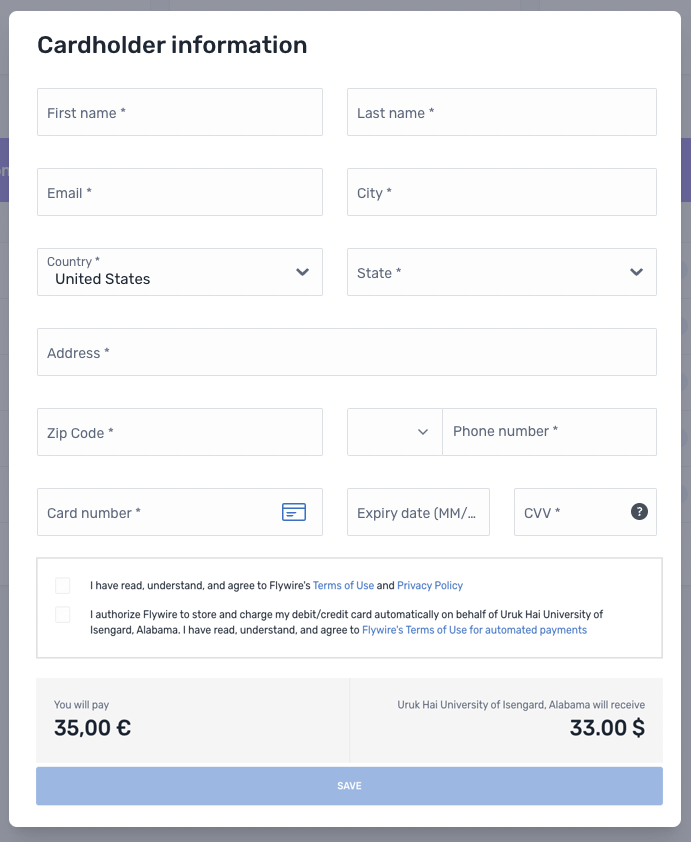

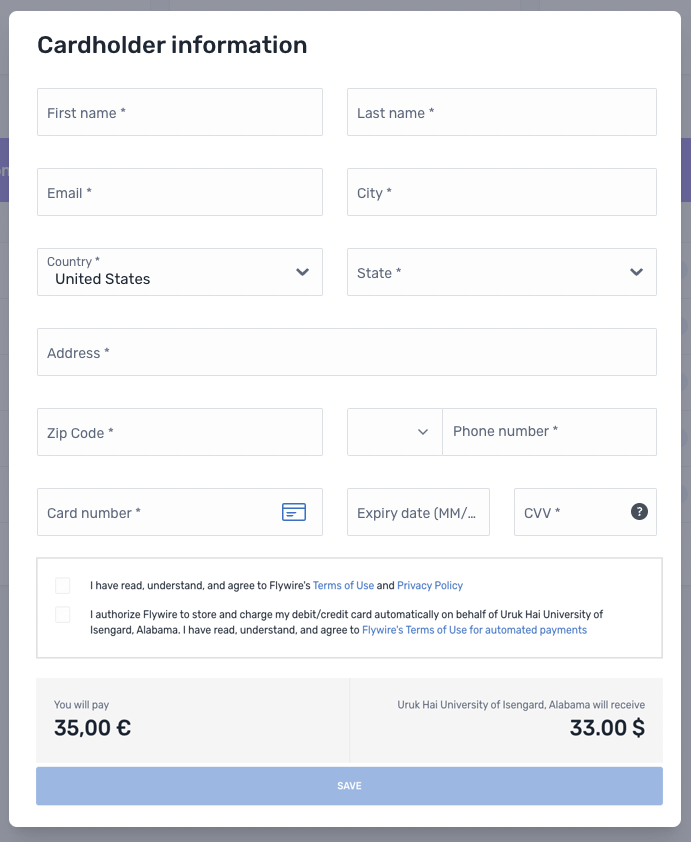

The payer sees a form that collects the payer and card information. With Smart Rendering, the appearance of the element and the displayed fields may vary based on your customizations.

|

Card tokenization (save card) This form collects the payer and card details. The data is then saved as a payment method token and mandate ID for future payments. No payment is being made with this form, which is why it doesn't show a payment amount. Customization Options

Checkout Session Settings

|

|

The payer sees a form that collects the payer and card information. After the payer confirmed the form, the payment is created. With Smart Rendering, the appearance of the element and the displayed fields may vary based on your customizations.

|

Card tokenization and pay (save card and make payment) This form collects the payer and card details, and immediately makes the first payment. The data is then saved as a payment method token and mandate ID for future payments Customization Options

Checkout Session Settings

|

|

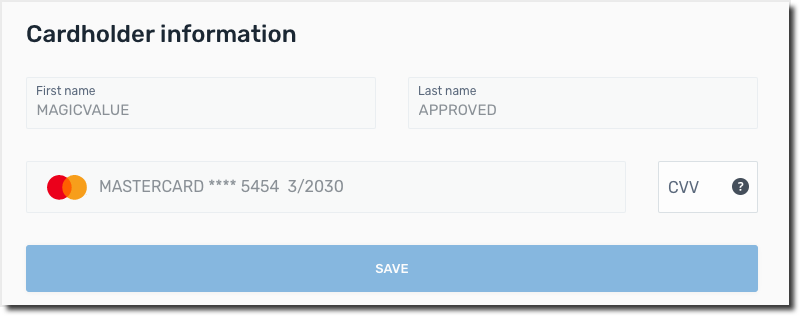

The payer sees a form where they can enter only the CVV number. All other fields are read-only

|

Card new mandate (use existing card for different plan) This form allows the payer to confirm their card's CVV to create a new mandate ID for recurring payments. It uses a saved card (which already has a payment method token) for a different plan (which requires a new mandate). The payer simply re-enters the CVV to prove consent for the new mandate. Customization Options

Checkout Session Settings

|

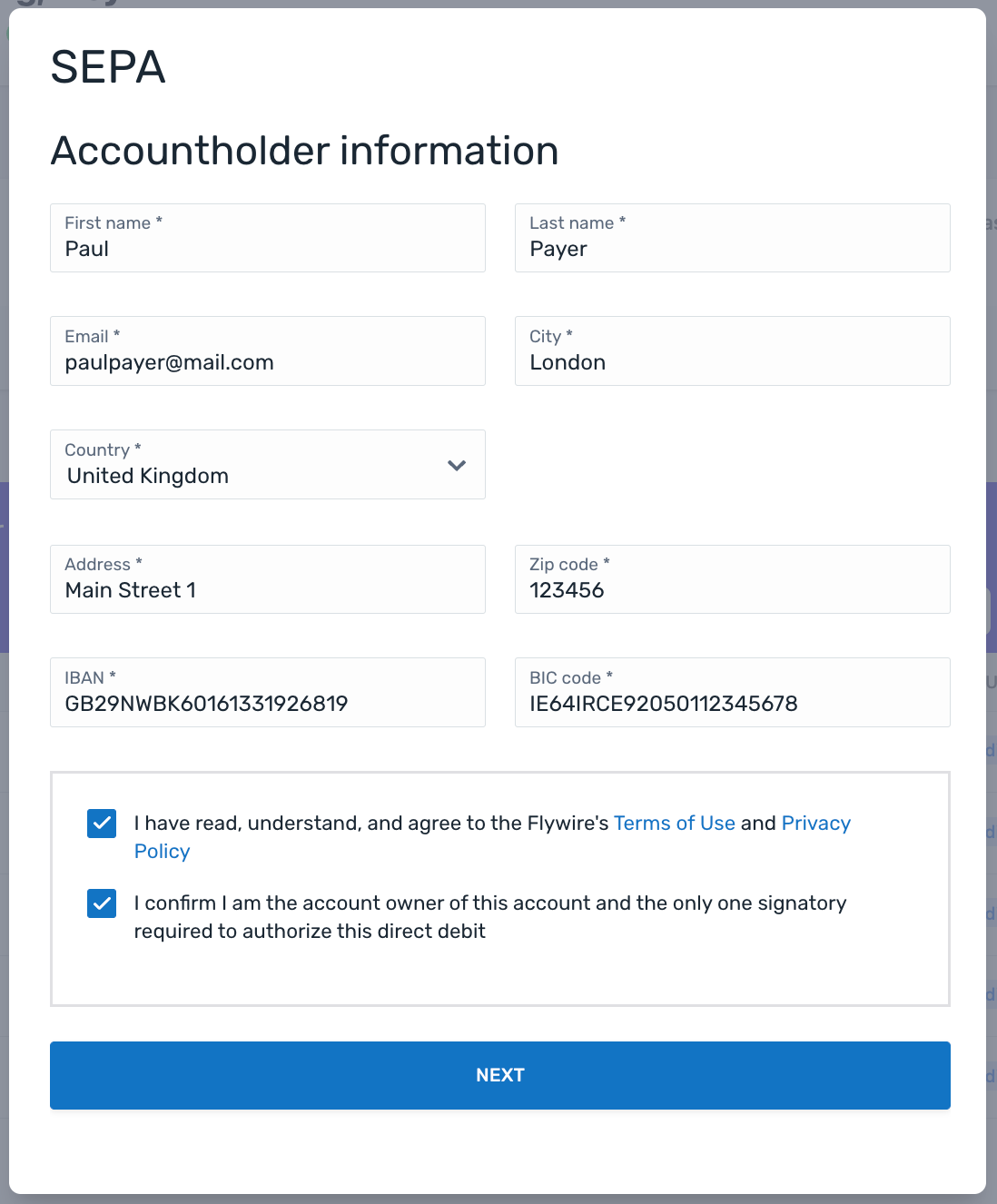

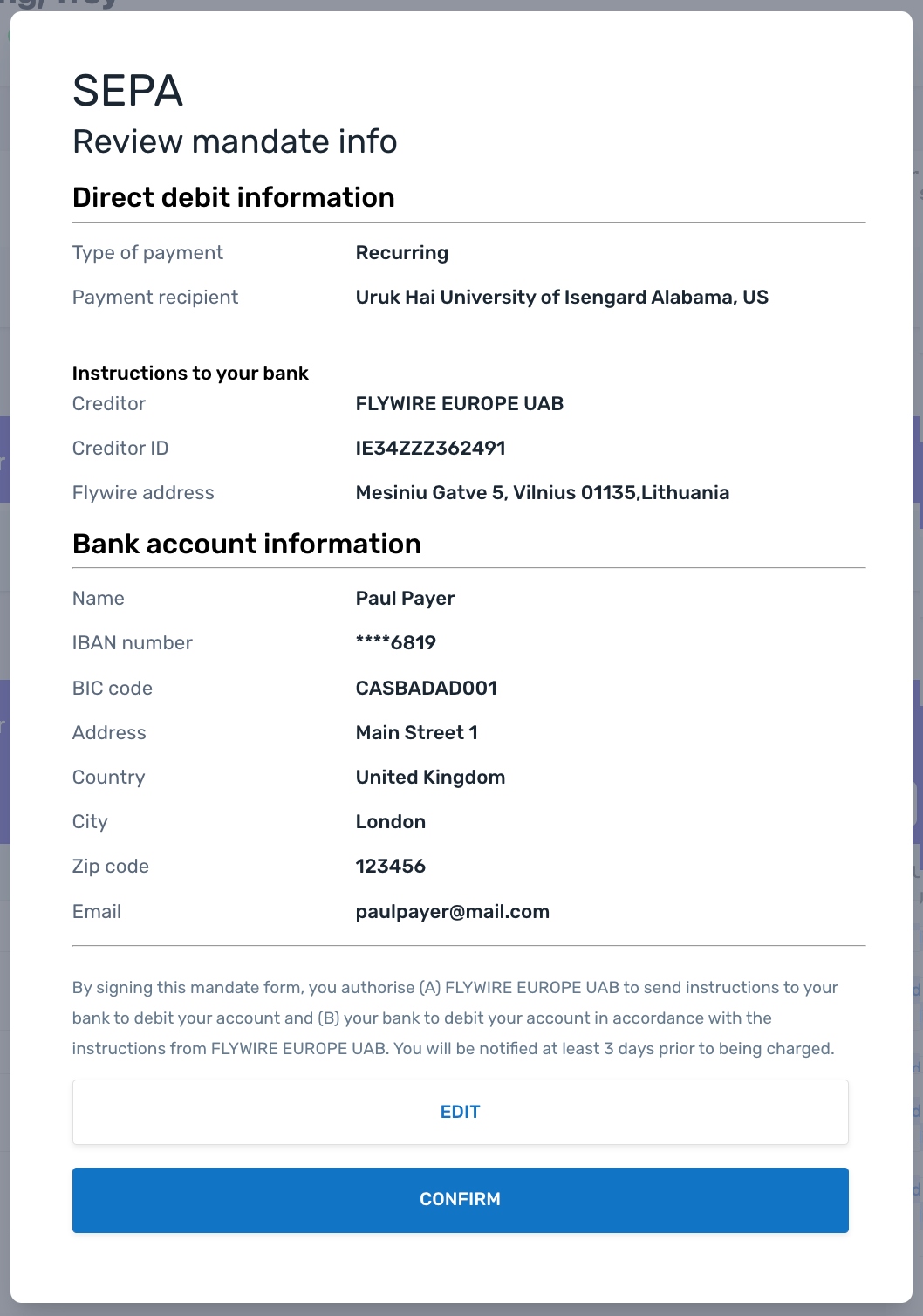

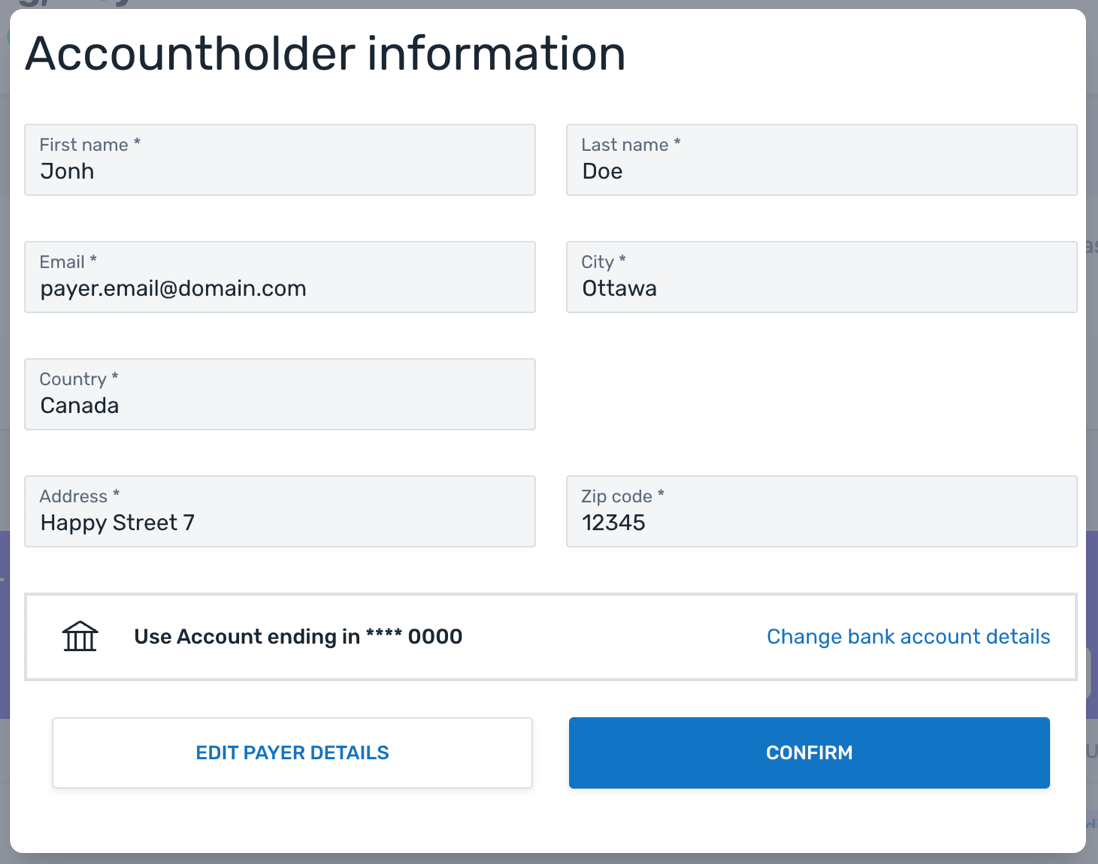

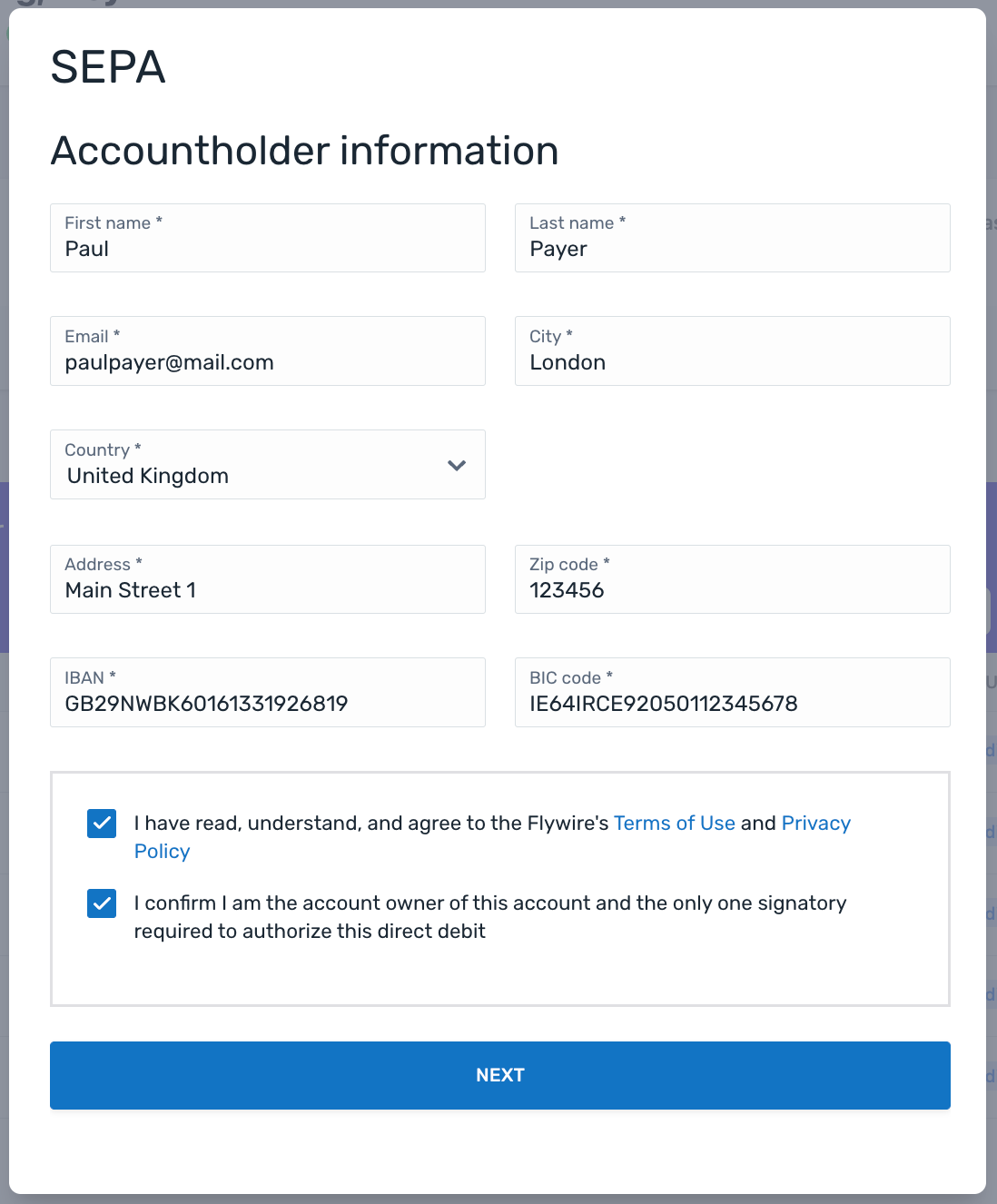

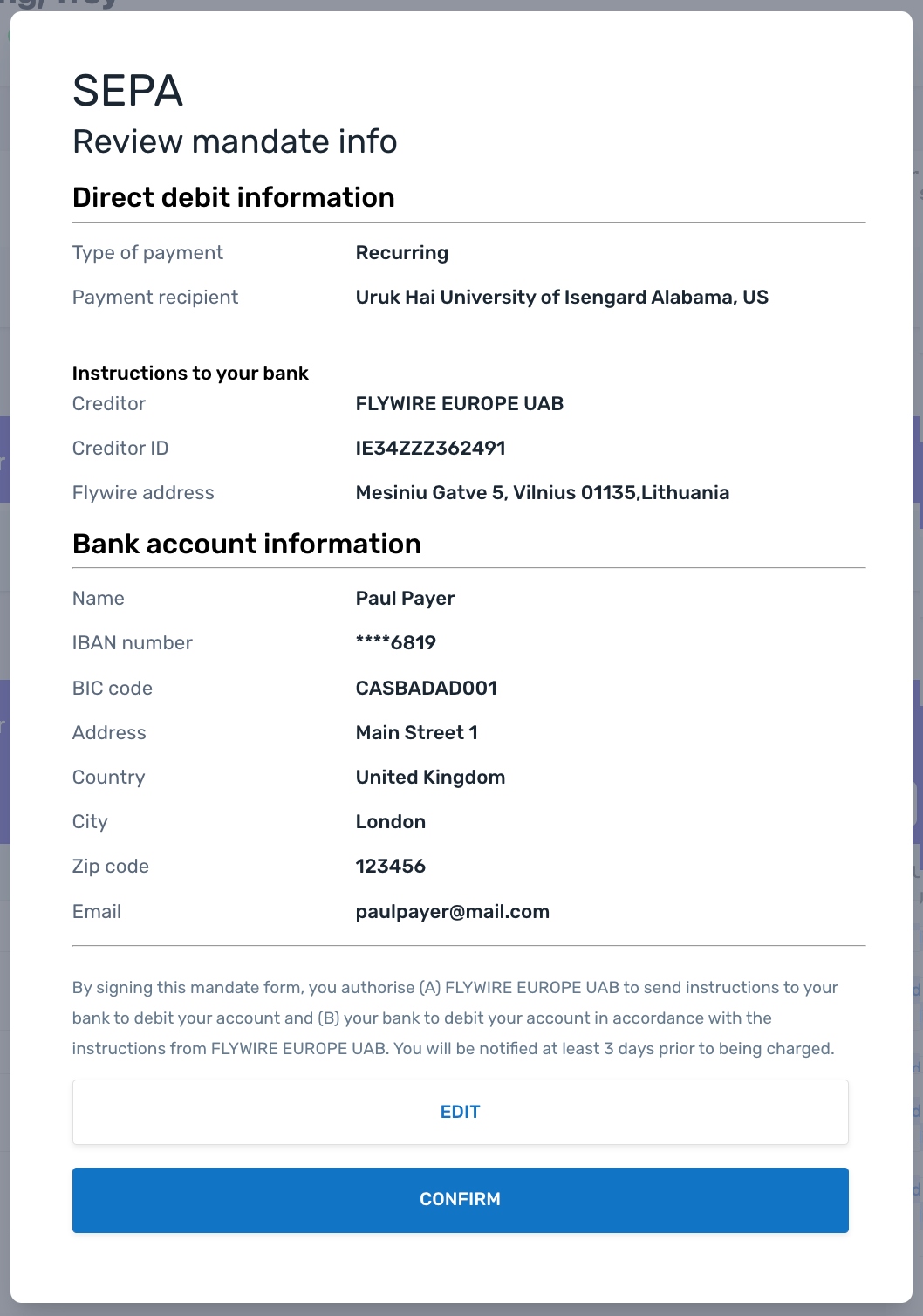

Your payer sees the SEPA form where they can enter their payer and bank account information.

After entering their info, your payer will see the mandate confirmation screen ("Review mandate info") to confirm or edit their info.

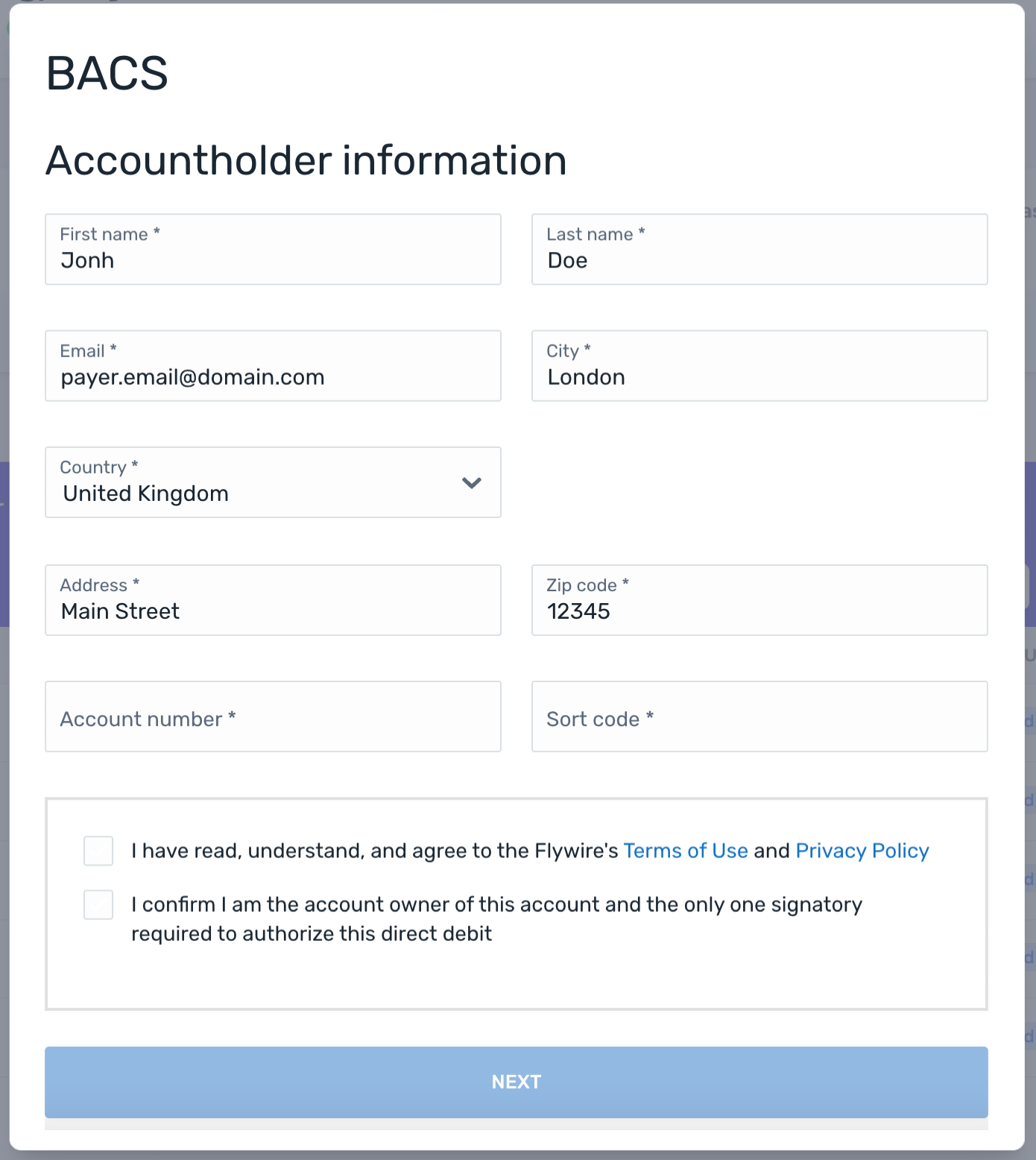

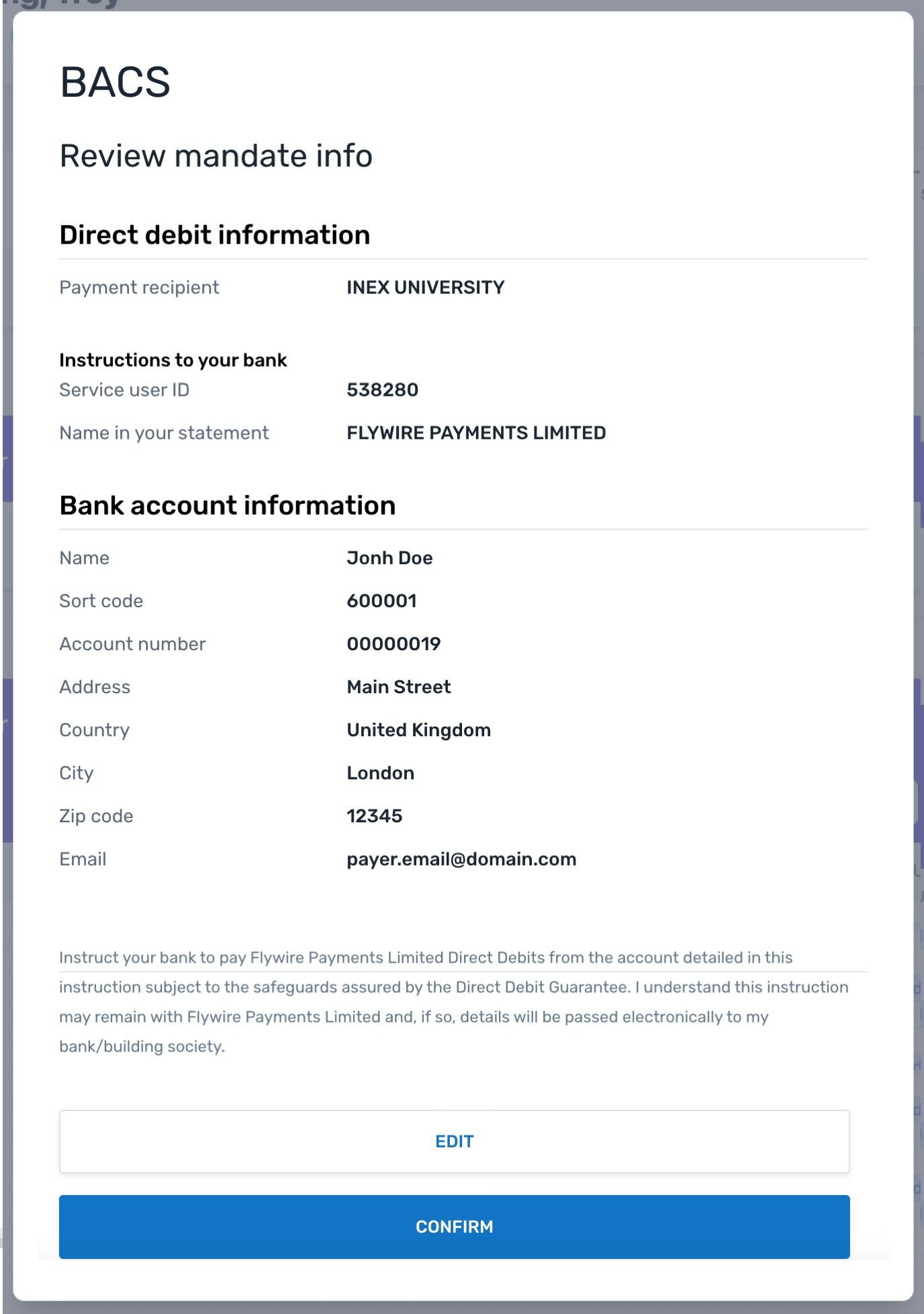

Your payer sees the BACS form where they can enter their payer and bank account information.

After entering their info, your payer will see the mandate confirmation screen ("Review mandate info") to confirm or edit their info.

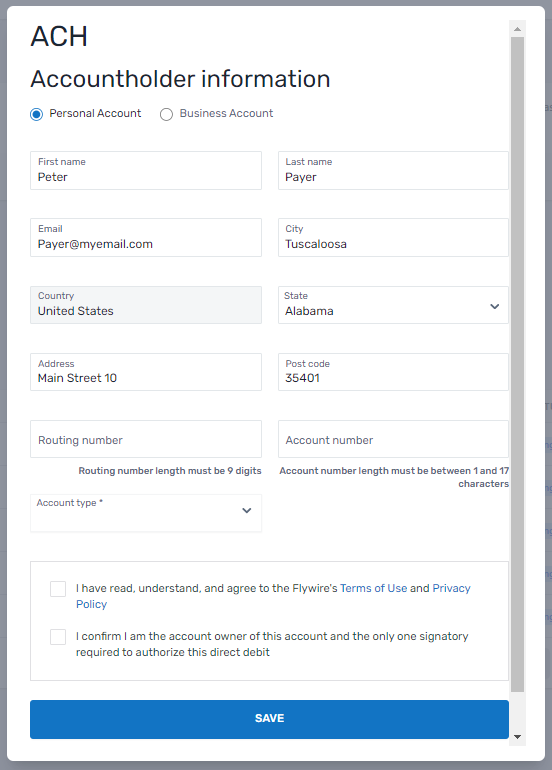

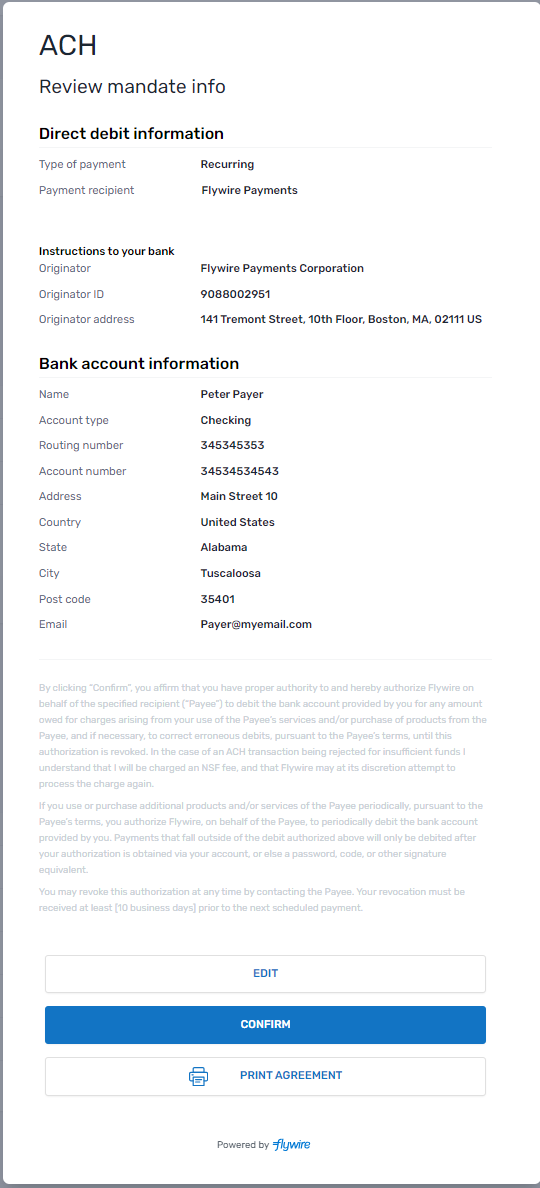

Your payer sees the ACH form where they can enter their payer and bank account information.

After entering their info, your payer will see the mandate confirmation screen ("Review mandate info") to confirm or edit their info.

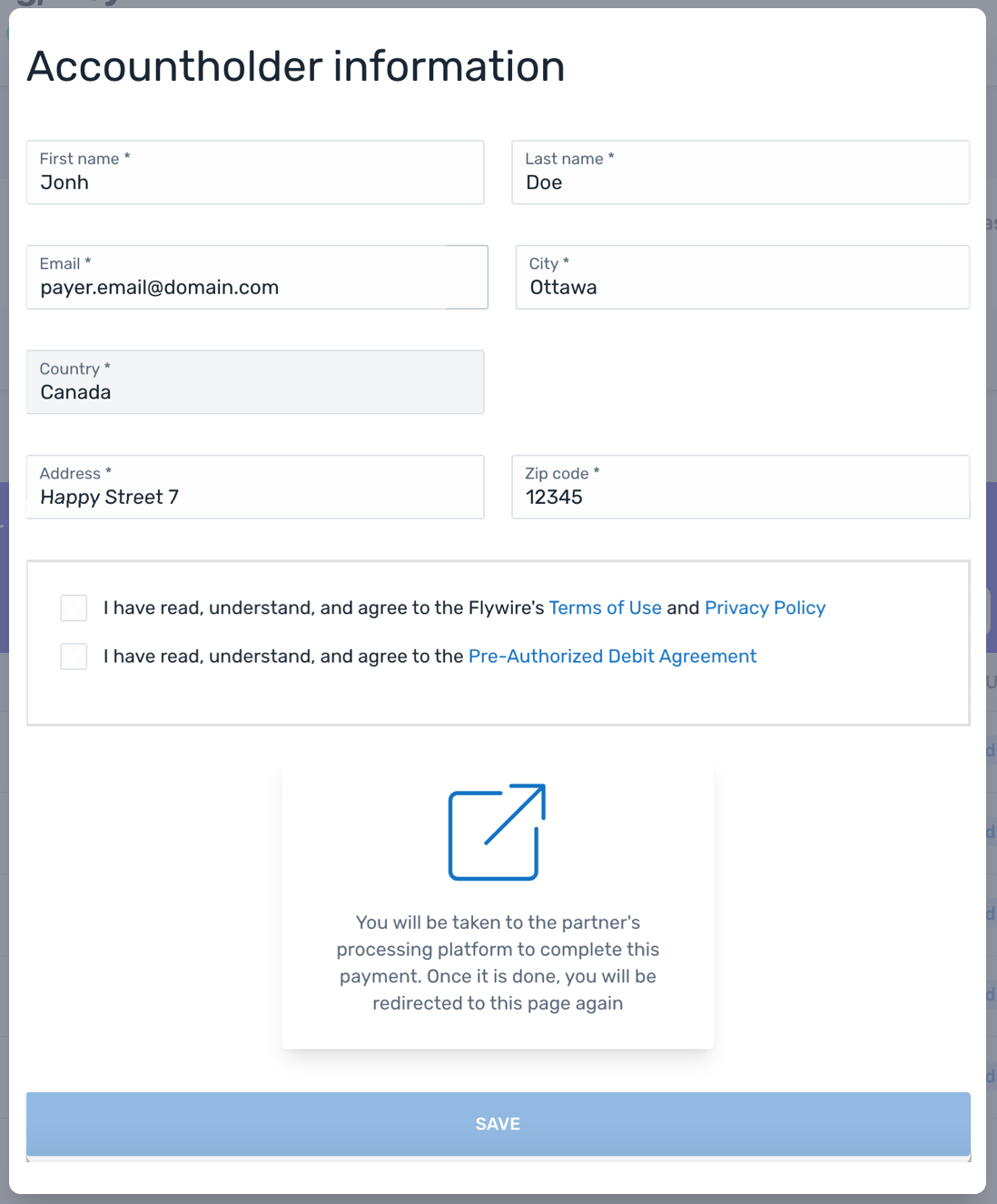

Your payer sees the EFT Canada form where they can enter their payer information.

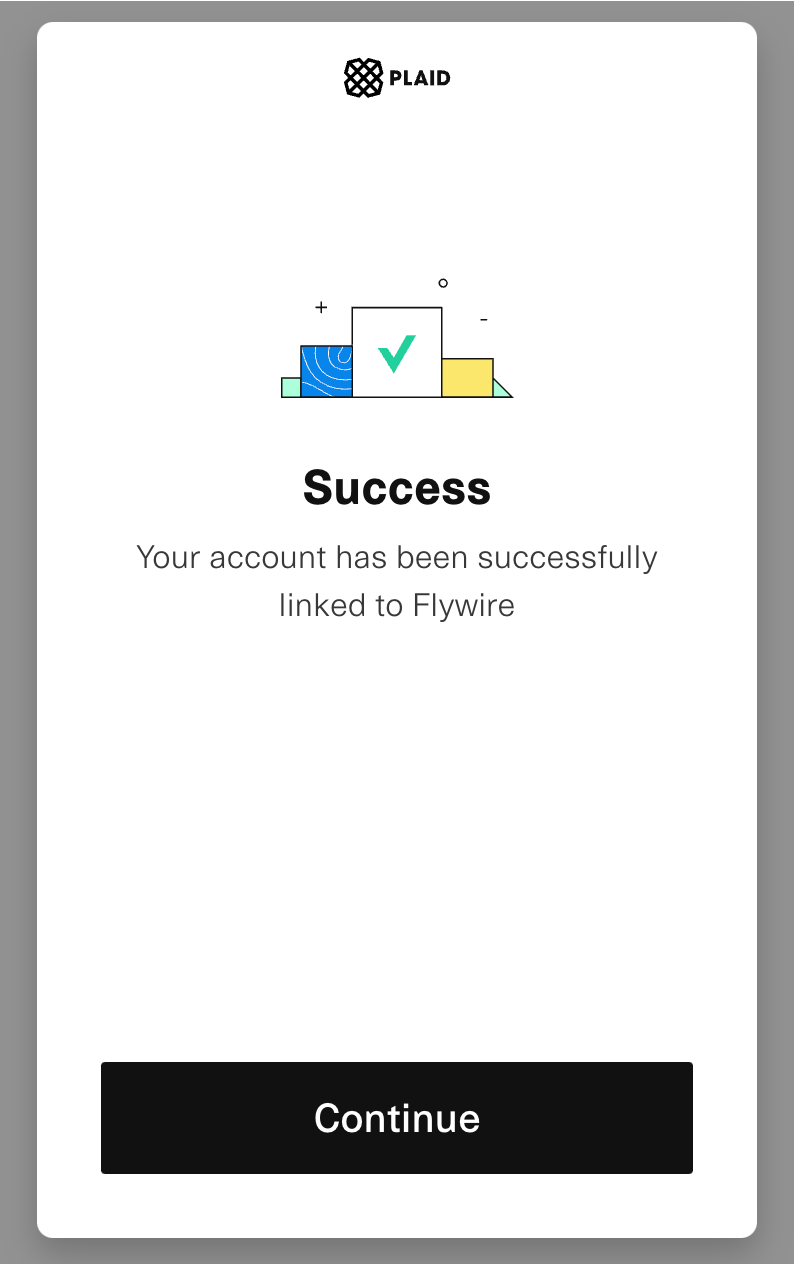

After entering their information, your payer will be redirected to Plaid. The third-party implementation will lead your payer through the steps to connect to their bank account.

After your payer successfully connected to their bank account, they will be redirected to the EFT Canada direct debit Form.

Back at the EFT Canada direct debit form, your payer can either edit their payer info, connect to a different bank account or confirm the information.

|

Direct debit tokenization (save bank account) This form collects the payer and bank account details. The data is then saved as a payment method token and mandate ID for future payments. No payment is being made with this form, which is why it doesn't show a payment amount. Supported direct debit schemes

Customization Options

Checkout Session Settings

|

|

Your payer sees the SEPA form where they can enter their payer and bank account information.

After entering their info, your payer will see the mandate confirmation screen ("Review mandate info") to confirm or edit their info.

|

Direct debit tokenization and pay (save bank account and make payment) This form collects the payer and bank account details, and immediately makes the first payment. The data is then saved as a payment method token and mandate ID for future payments. Supported direct debit schemes:

Customization Options

Checkout Session Settings

|

Checkout for Flywire-Managed Recurring Payments

Checkout for Flywire-Managed Recurring Payments

What are Recurring Payments?

Recurring payments are payments that charge the same card or bank account multiple times.

The payer agrees to the plan for the recurring payments (for example multiple installments or an ongoing subscription), and allows their card or bank account information being stored for future payments. This means the future payments can be charged without the payer being present.

What are Flywire-managed Recurring Payments?

With Flywire-managed recurring payments, you use Flywire's pre-defined installment plans. You only have to configure the plan settings (for example the number of installments) in Flywire Dashboard, Flywire will take care of the rest.

Since Flywire knows your plan settings, payments get initiated automatically according to the schedule.

Flywire also manages all emails to your payers on your behalf - these are mandatory to inform them about the recurring payments.

You need access to Flywire Dashboard to define the settings for the plans. If you don't have access yet, contact your Relationship Manager.

Available payment methods:

-

Card

Available form:

| Checkout Session type | recurring |

| Checkout Session schema | none - parameter has to be left out |

| For details see | Creating a Checkout Session for Flywire-Managed Recurring Payments |

|

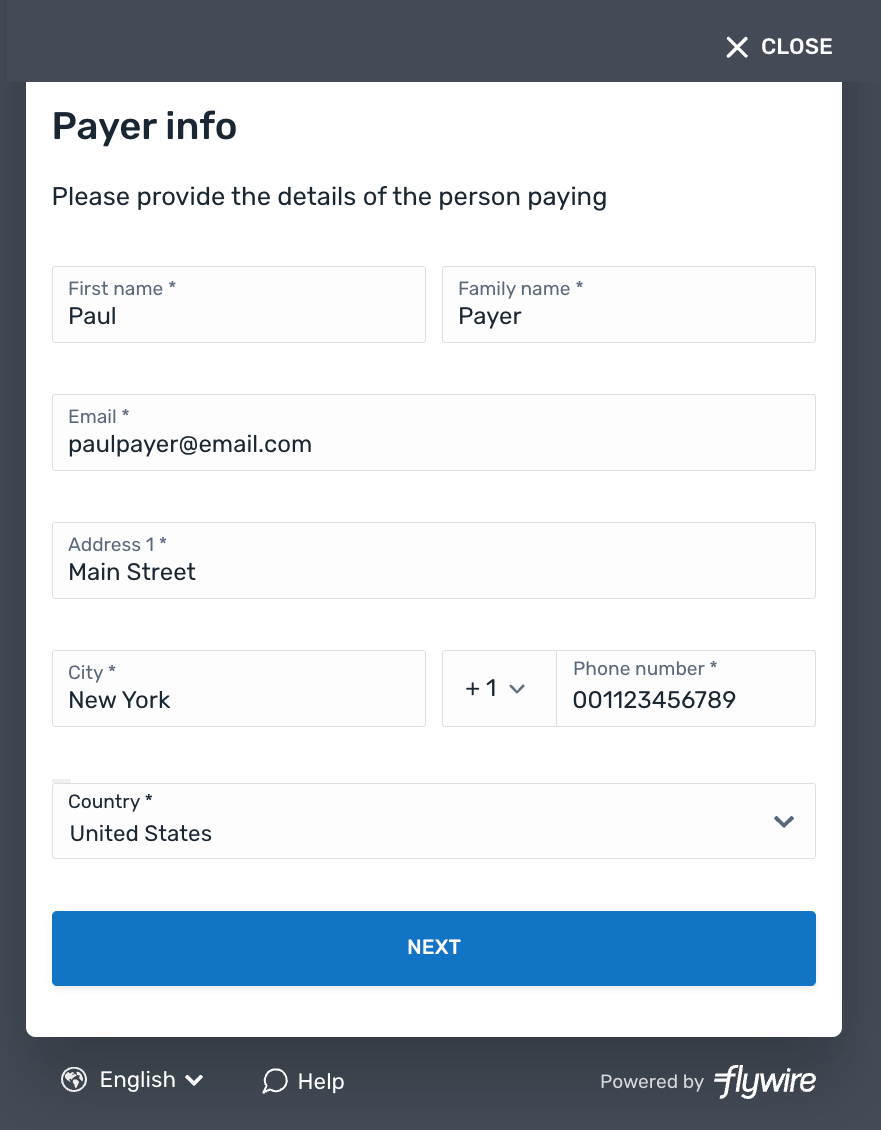

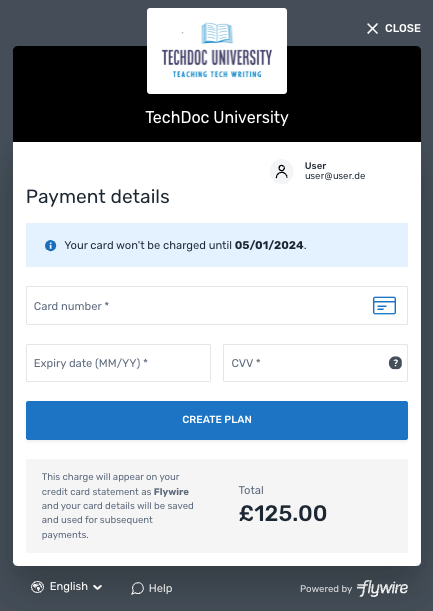

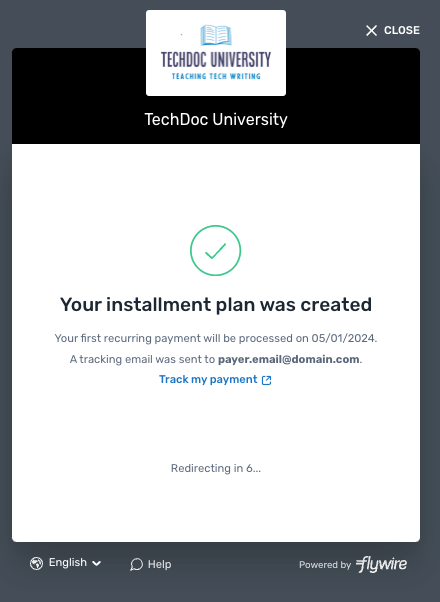

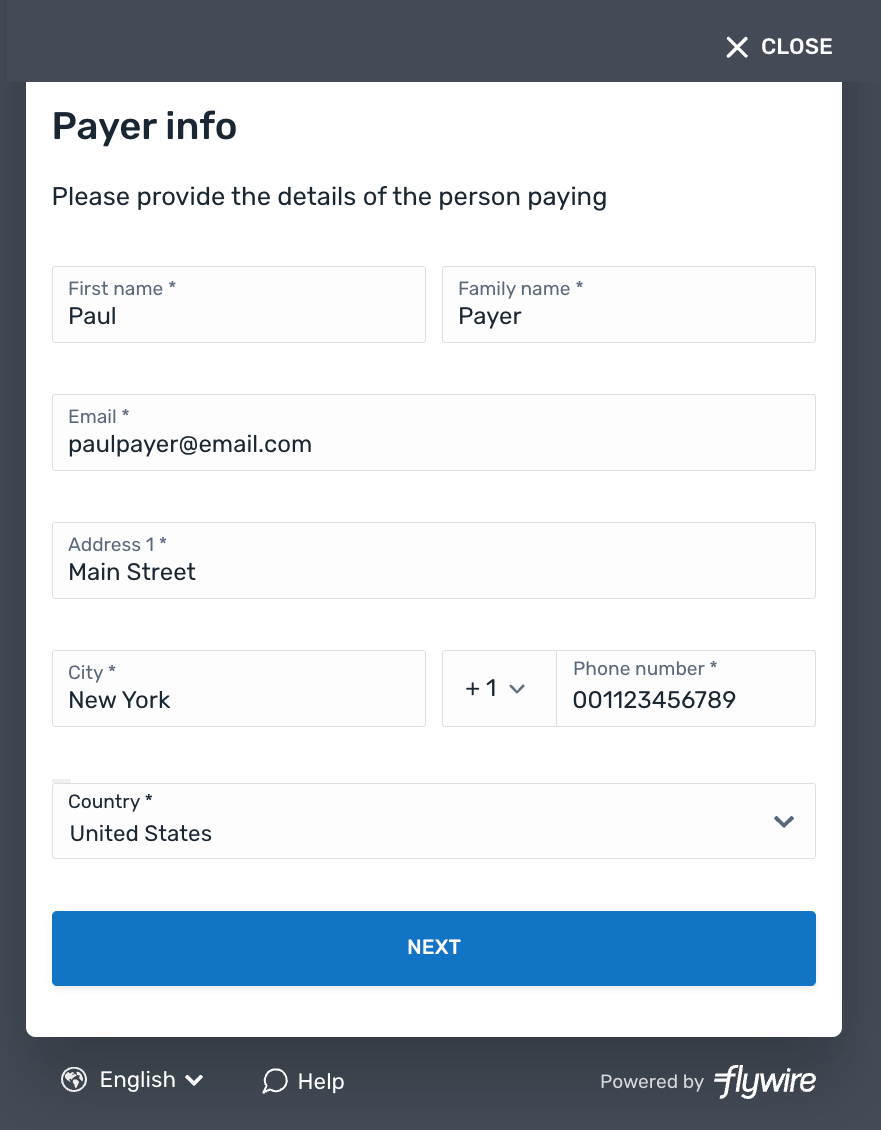

Your payer sees the Flywire-Plans form that collects the payer information.

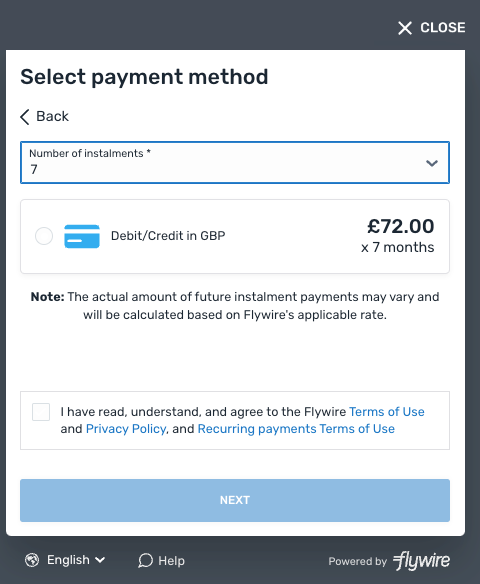

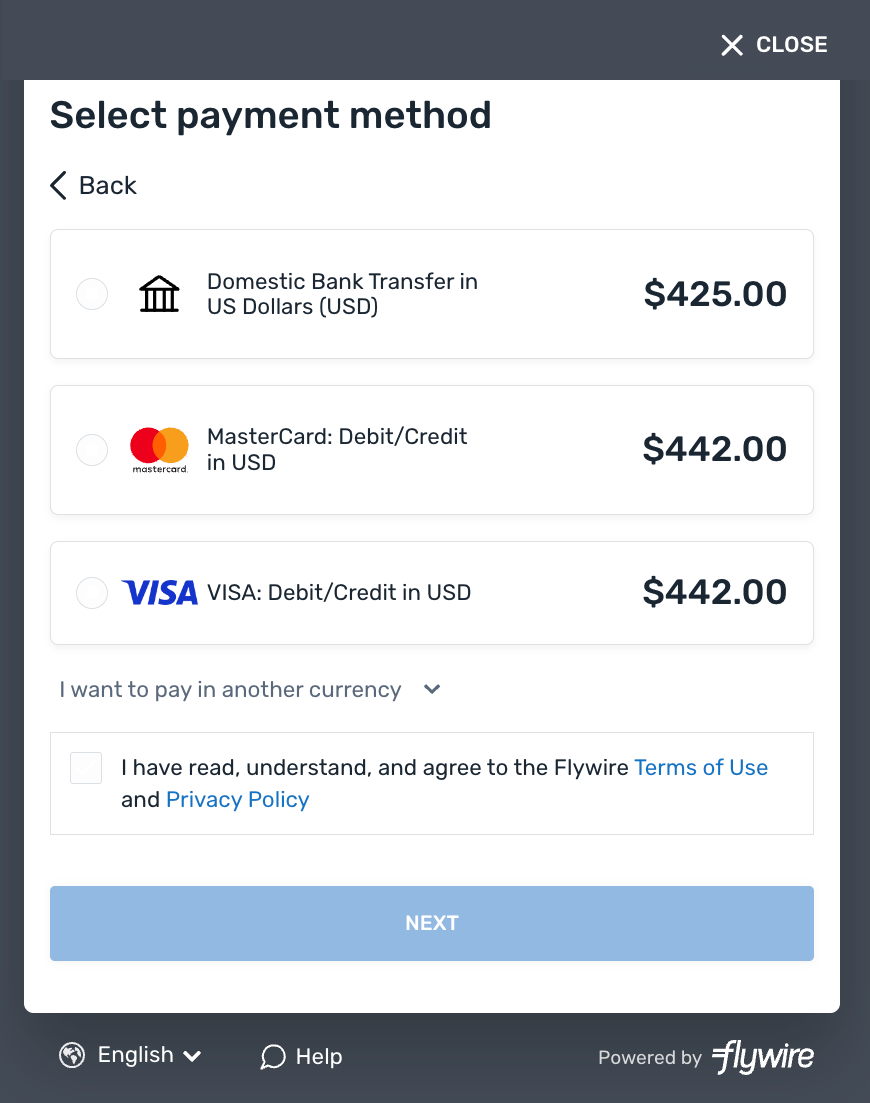

After entering their information, your payer is asked to pick the installment plan (number of installments) and the payment method they want to use.

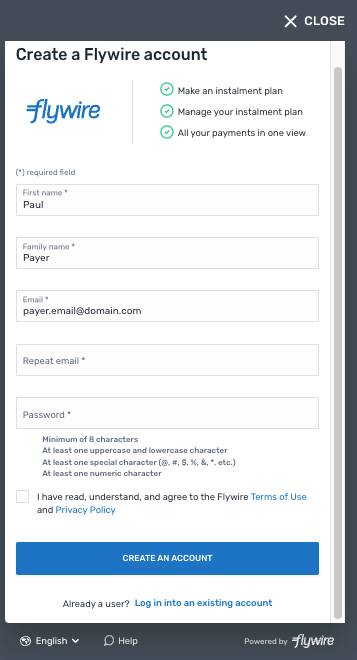

Your payer is then asked to either create a Flywire account or log into an existing one.

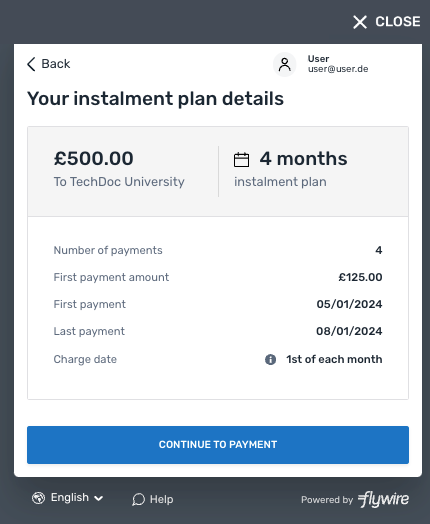

After creating an account or logging into an existing one, your payer sees an overview of the plan they choose.

Your payer is then asked to enter their card information to pay for the payments.

An installment plan with the information provided is now created. The window will close automatically after a few seconds.

|

Flywire-managed recurring payments This form collects the payer's information (name, etc.) and then asks the payer to pick their desired installment plan. With Flywire-managed recurring payments, you use Flywire's pre-defined installment plans. You only have to configure the plan settings (for example the number of installments) in Flywire Dashboard, Flywire will take care of the rest. Since Flywire knows your plan settings, payments get initiated automatically according to the schedule. Flywire also manages all emails to your payers on your behalf - these are mandatory to inform them about the recurring payments. You need access to Flywire Dashboard to define the settings for the plans. If you don't have access yet, contact your Relationship Manager. Available payment methods:

Customization Options When creating a Checkout Session, you have the option to configure the form to skip the payer information page. The show_payor_information parameter gives you the option to skip the payer information page of the form. This shortens the time your payer has to interact with the form if you already provided all the necessary information. If you skip the page, the page for selecting the payment method is shown immediately. If you don't provide the parameter, the payer information page is shown by default. Note:

Possible values:

Checkout Session Settings

|

Checkout for One Off Payments

Checkout for One Off Payments

A One Off Payment is a single payment made once. For One Off Payments, no card or bank account details are stored (unlike Recurring Payments, which store card or bank account information for multiple payments that are part of a plan).

Which payment methods are available depends on the recipient of the payment.

Available form:

| Checkout Session type | one_off |

| Checkout Session schema | one_off |

| For details see | Checkout for One Off Payments |

|

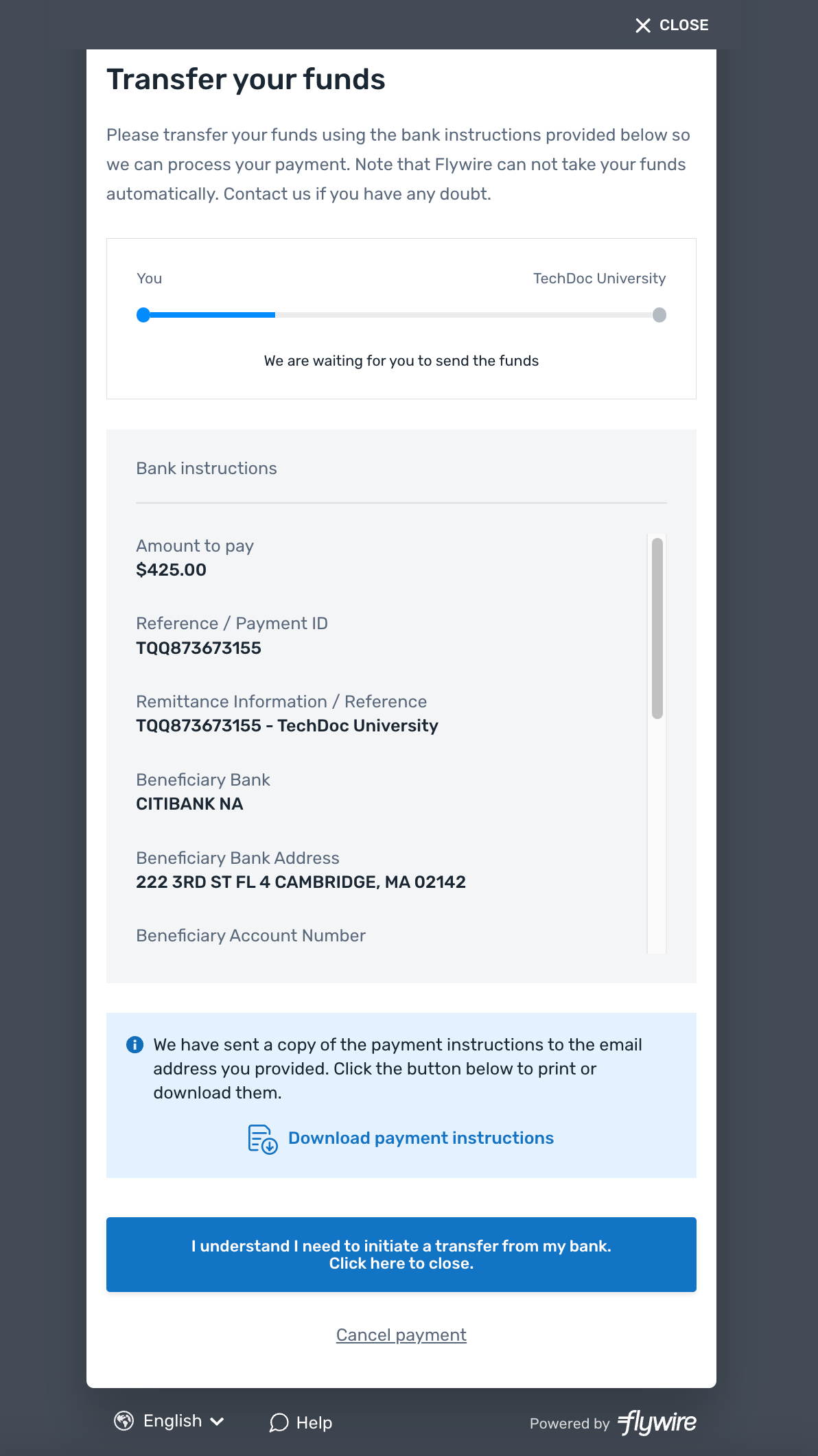

Your payer sees the form that collects the payer information.

After entering their information, your payer is asked to pick the payment method they want to use.

Depending on the payment method, the last screen will either ask for card or bank account information to be used for this payment or give the payer bank details so that they can make a bank transfer.

|

One Off Payment This form collects the payer's information (name, etc.) and then asks the payer to pick a payment method. Depending on the payment method, it either asks the payer for their card details, bank account details, or to make a bank transfer. This form is for one time payments, which means, card or bank account details are not being stored. Customization Options When creating a Checkout Session, you have the option to configure the form to skip the payer information page. The show_payor_information parameter gives you the option to skip the payer information page of the form. This shortens the time your payer has to interact with the form if you already provided all the necessary information. If you skip the page, the page for selecting the payment method is shown immediately. If you don't provide the parameter, the payer information page is shown by default. Note:

Possible values:

Checkout Session Settings

|

Checkout for Pre-Authorization Payments

Checkout for Pre-Authorization Payments

A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds.

Pre-Authorization Payments are only available for same-currency payments, not for FX payments.

Example for a Pre-Authorization Payment:

A guest checks into a hotel for a three-night stay, and you place a pre-authorization on their credit card for the estimated cost of the stay.

Check-In: You pre-authorizes $600 on the guest's credit card ($150 per night plus $150 deposit). This reduces the guest's available credit by $600 but is not yet charged.

During the Stay: The guest orders room service for $50.

Check-Out: The final bill is $500 ($450 for room charges plus $50 for room service). You capture $500 from the pre-authorization. The remaining $100 from the original hold is returned to the guest's available credit.

Available payment methods:

-

Card

Available form:

| Checkout Session type | tokenization_and_pay |

| Checkout Session schema | cards |

| For details see | Creating a Checkout Session for Pre-Authorization Payments |

|

The payer sees a form that collects the payer and card information. After the payer confirmed the form, the payment is created. With Smart Rendering, the appearance of the element and the displayed fields may vary based on your customizations.

|

Pre-Authorization Payment This form collects the payer and card details. The funds are being reserved on the card and you can capture them later. Customization Options

|