Payments

List of endpoints

| Description | Endpoint |

|---|---|

|

POST/payments/v1/payments/charge

|

|

| Capturing the Funds for a Pre-Authorization Payment |

POST/payments/v1/payments/{paymentID}/captures

|

| Adjusting or Extending a Pre-Authorization Payment |

POST/payments/v1/payments/{paymentID}/authorization_adjustments

|

|

POST/payments/v1/payments/{paymentID}/process

|

|

|

POST/payments/v1/payments/{paymentID}/cancel

|

|

|

GET/payments/v1/payments

|

|

|

GET/payments/v1/payments/{paymentID}

|

|

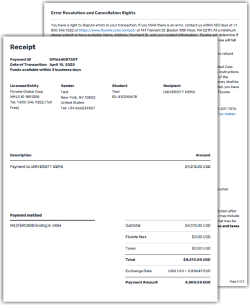

| Getting a Payment Receipt |

GET/payments/v1/payments/{paymentID}/receipt

|

|

POST/payments/v1/payments/{paymentID}/refunds

|

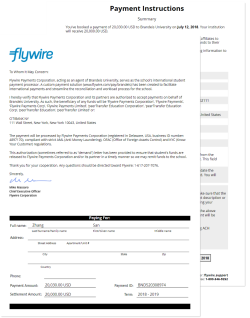

What is a Payment?

In everyday usage, a "payment" usually refers to the entire process of making a payment through Flywire. But the term "payment" has a specific meaning in Flywire:

-

A payment is considered created when a payment reference is assigned to it, not any earlier stage in the process.

What is the payment reference?

What is the payment reference?

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

-

-

When the payment reference is assigned, two things happen:

-

The FX rate is locked in for FX payments (FX = "foreign exchange", a payment where one currency has to be converted to a different currency).

-

The payment starts its journey in status initiated, and its progress traceable via the payment reference. If you are using Flywire Dashboard, you can view the payment on your dashboard.

-

Creating a Payment within a Self-Managed Recurring Plan

Mandatory emails

Information for charging direct debit payments

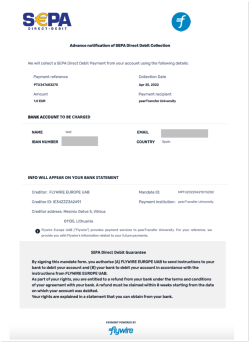

For direct debit payments (SEPA and BACS), the payer must be informed about the upcoming charge. To ensure this, charging a direct debit payment will trigger an email to inform the payer, and the actual charge will automatically be delayed for 3 business days.

This email is only necessary for SEPA and BACS. The email is automatically sent by Flywire (for SEPA) or Finastra (for BACS),

After charging a direct debit payment it can take up to 10 business days before the funds appear in your bank account (3 days of charge delay plus up to 7 days of collecting and processing the charge).

Request

This endpoint is only for creating follow-up payments of a self-managed plan (see Use Case: Self-Managed Recurring Payments).

This endpoint creates a recurring payment within a self-managed plan. This is a manual step since Flywire doesn't know your payment schedule, meaning you have to ensure that recurring payments are created on time. If you want recurring payments to get created automatically, you can use Flywire-Managed Plans.

You need a payment method token, mandate ID and payer ID to use this request.

-

The payment method token contains payer and payment method information.

The payer and payment information has been gathered via a UI form and stored in the payment_method object. This information is used for the future payments. The payer information is passed via the payment_method_token when you charge a payment.

Where do I find the payment method token?

Where do I find the payment method token?

The payment method token is returned to you in the response after you confirmed a Checkout Session.

You can also find all payment method tokens for a payer (identified by their payor_id) with this request:

GET/payments/v1/payors/{payorId}/payment_methodsFor details see Getting a List of all stored Payment Methods for a Payer.

-

It is mandatory to include the mandate ID when charging a recurring payment.

Why is it mandatory?

Why is it mandatory?

For some card payments, this is mandatory to be compliant with policies. For example the mandate ID serves as the "Visa Transaction ID", which is mandatory since October 31st, 2022 (not providing the Visa Transaction ID could result in soft declines and fees for non-compliance). Other payment processors may require a similar ID for consent verification in the future.

Flywire generates mandate IDs for both cards and bank accounts to ensure future readiness.

Where do I find the mandate ID?

Where do I find the mandate ID?

You can find all mandate IDs for a payment method token with this request:

GET/payments/v1/payors/{payorId}/payment_methods/{token}For details see Getting the Mandate IDs for a Payment Method Token.

Parameters for the Request Body

charge_intent object

The mode of a payment depends on three factors:

-

Frequency: Are the intervals for the payment regular or irregular?

-

Purchase: Is it one single purchase or are new goods/services purchased?

-

Delivery: Are the goods/services delivered once or in multiple deliveries?

Available modes

| Mode | Frequency | Purchase | Delivery |

|---|---|---|---|

|

installment |

regular or irregular intervals |

Single purchase of goods or services |

Single delivery (can be in advance, at any time during the plan, or at the end) |

|

subscription |

Regular intervals |

Multiple purchases (for new or renewed goods or services) |

Multiple and regular deliveries |

|

unscheduled |

No pre-agreed intervals |

Multiple purchases (for new or renewed goods or services) |

Multiple deliveries at no pre-agreed intervals |

Provide the mandate ID for this payment.

You can find all mandate IDs for a payment method token with this request:

For details see Getting the Mandate IDs for a Payment Method Token.

The mandate ID is a Flywire-generated ID that represents the payer's consent for recurring payments, much like a signature authorizing future payments.

After tokenizing a card or bank account, the mandate ID is returned to you in the mandate_id parameter or in the id parameter inside the mandate object.

| Payment Method | Mandate ID Format |

|---|---|

| Bank account |

MT+ recipient ID + date of mandate generation + string of characters Example: MTQQ20240430NTZTZX |

| Card that has only been tokenized, payments are charged later |

MC + ZER + date of mandate generation + string of characters Example: MCZER20240430SaA8rNHh |

| Card that has been tokenized and the first payment has been charged immediately |

MC + recipient ID + date of mandate generation + string of characters Example: MCTQQ20240430HaB7fKMg |

It is mandatory to include the mandate ID when charging a recurring payment.

For some card payments, this is mandatory to be compliant with policies. For example the mandate ID serves as the "Visa Transaction ID", which is mandatory since October 31st, 2022 (not providing the Visa Transaction ID could result in soft declines and fees for non-compliance). Other payment processors may require a similar ID for consent verification in the future.

Flywire generates mandate IDs for both cards and bank accounts to ensure future readiness.

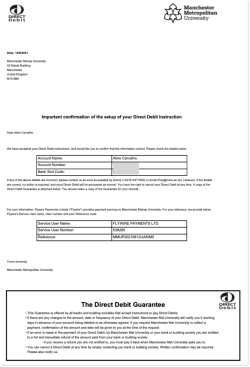

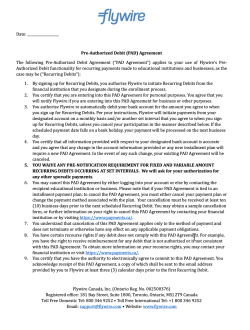

For bank accounts, the mandate is represented by the mandate ID and additionally in PDF form.

The mandate PDF is the mandate fully written out "on paper" (but paperless as a PDF). The PDF is delivered to your payer by email.

There are different types of PDFs depending on the direct debit scheme for the payments:

|

The SEPA mandate is a PDF with the written out SEPA contract. A SEPA mandate has a specific format and strictly defined content. It is part of the SEPA payment system, and you cannot charge a bank account without having a SEPA mandate.

The file name for the PDF with the SEPA mandate contains the date the SEPA mandate was created and the mandate ID that was generated by Flywire.

The SEPA mandate is created and sent to your payer by Flywire, you don't need to create and send it yourself. |

|

The BACS mandate is a PDF with the written out contract including the Direct Debit Guarantee for BACS. A BACS mandate has a specific format and strictly defined content. It is part of the BACS payment system, and you cannot charge a bank account without having a BACS mandate. The BACS mandate is created and sent to your payer by a third-party provider, you don't need to create and send it yourself.

|

|

The mandate PDF for EFT Canada is called PAD (Pre-Authorized Debit Agreement). It is a PDF that always has the same format and content, but you need to provide the current date. Process for delivering the mandate (PAD) for EFT Canada:

|

|

The ACH mandate is a PDF containing the written ACH authorization agreement. An ACH mandate has a specific format and required content, as defined by ACH regulations. It is part of the ACH payment system, and you cannot charge a bank account without obtaining an ACH mandate.

The ACH mandate is created and sent to your payer by Flywire, you don't need to create and send it yourself. |

Provide the payment method token for this payment.

The payment method token is a unique string of numbers and characters that gets assigned to a card or bank account when you store them via Flywire Elements. It identifies the payment method (e.g., last four digits of a card or bank account) and includes payer details, such as the cardholder or account owner.

Format:

String of 20 characters, for example:

a1b2c3d4e5f67890abcd

The payment method token is returned to you in the response after you confirmed a Checkout Session.

You can also find all payment method tokens for a payer (identified by their payor_id) with this request:

For details see Getting a List of all stored Payment Methods for a Payer.

The payor_id depends on how you want to uniquely identify a payer. Usually, you use an ID from another system, for example your ERP. Spaces are not allowed.

When you are creating follow-up payments you must use the same payor_id you used when you created the Checkout Session.

recipient object

The recipient ID (also called portal code).

The recipient ID identifies the recipient (also called portal). The recipient ID has been assigned by Flywire when the recipient has been set up.

Format:

Either: 3 letters (ABC)

Or: 5 alphanumeric characters, always starting with a letter (ABC1D)

fields array

It depends on the recipient which fields are optional or required. If a field is required, you must provide it here. Optional fields can be left out.

You have two options:

Checking via the API

You can check which fields are required for a recipient (portal) with this request (replace {recipientId} with the recipient ID):

Required fields have the required parameter set to true. For more info see Getting Details about a Recipient.

Checking online

You can check which fields are required by checking your portal configuration.

Identifier of the field.

The value for this field.

items array

An item is something that your payer can pay for (for example: tuition fees, housing, etc.). When you create a payment, you display the items to your payer and they can choose for which items they want to pay. How many items there are depends on the recipient's configuration.

You can only use one item in this request. The id of the item must be called default.

Identifier of the item.

You can only use one item in this request. The id of the item must be called default.

The amount for this item in the billing currency,

The billing currency is the currency in which the recipient of the payment is billing their payer. The billing currency depends on the

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

metadata object

You can specify up to 20 metadata pairs.

Maximum length for keys: 40 characters

Maximum length for values: 500 characters

Custom metadata is additional data entered by you when you create the payment, for example data you need to identify the payment in your system. Metadata can be useful when you want to add data that is not already covered by recipient fields, for example if you are not the one who set up the recipient and have no influence on the fields.

Metadata consist of pairs of keys and values, for example key Payer_ID_From_My_System and value ID12345.

The notifications URL enables you to receive callbacks about the payment status (see Payment Status Notifications).

The notifications URL is the dynamic URL for receiving callbacks.

There are two different URLs for receiving callbacks:

Static URL

For API integrations:

When you set up your application that accesses the Flywire API, you had the option to define a notifications URL. This is the static notifications URL. Callbacks will be sent to this URL for all payments you created via the Flywire API.

The recipient of a payment may also have a static notifications URL defined which might be different from your static notifications URL as a client. In that case, callbacks will also be sent to the recipient's notifications URL.For other integrations:

When you set up your portal together with Flywire, you had the option to define a callback URL for that portal. Callbacks will be sent to this URL for all payments for this portal.

If you don't use a static callback URL yet and want to start using it, please contact the Solutions team.

Dynamic URL

The URL you can set in a parameter when you are creating a payment is the dynamic notifications URL. Since this URL can be different for every payment you create, it is called dynamic.

How defining static and dynamic URLs affect callbacks

= not set = not set |

= set = set |

| Static URL |

Dynamic URL |

Result |

|

|

You won't receive notifications. |

|

|

You'll receive notifications to your static URL. |

|

|

For API integrations: The dynamic URL will override the static URL and you'll receive notifications only to the dynamic URL. For other integrations: You'll receive callbacks to both URLs. This is called "dual callback URL". A dual callback URL means you defined a static URL in your portal and you are sending callbacks to a different callback URL via the parameter for the payment. In this case, callbacks will be sent to both URLs. This

approach can be useful if you want to update two separate systems.

|

|

|

You'll receive notifications to your dynamic URL |

The external reference.

The external reference helps you to identify a payment, since the Flywire-generated payment reference might not be the way you typically identify payments. With the external reference, you can enter your own identifier, such as an ID or invoice number.

The external reference is included in all status notifications to help you map a payment to a callback notification. (see Payment Status Notifications)

curl https://base-url-placeholder/payments/charge

-X POST

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"

-d '{

"charge_intent": {

"mode": "subscription"

},

"mandate_id": "MCHUV20220526UAUTYQ8W",

"payment_method_token": "e1278a8863eaef9b7a7c",

"payor_id": "payor_CCC",

"recipient": {

"id": "FWU",

"fields": [

{

"id": "custom_field_1",

"value": "ID12345"

},

{

"id": "custom_field_2",

"value": "2020"

}

]

},

"items": [

{

"id": "default",

"amount": 5000

}

],

"metadata": {

"Internal-ID": "12345",

"Int-Comment": "A comment about this payment"

},

"notifications_url": "http://a-callback-url.com/callback",

"external_reference": "a-reference"

}Response

There are three possible outcomes:

The payment was created and successfully charged.

The payment was created and successfully charged.

The payment was created but the charging was not successful.

The payment was created but the charging was not successful.

There was an error and the payment was not created.

There was an error and the payment was not created.

-

Payment created and charged

Payment created and charged -

Charge failed

Charge failed -

404 Error

404 Error -

422 Error

422 Error -

500 Error

500 Error

The payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

charge_info object

The payment amount in the payer currency.

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

The payer currency.

Format:

Three-letter ISO 4217 currency code, for example EUR.

charge_result object

The status of the attempted charge. Note that this charge status doesn't mean that funds have successfully been transferred. It gives you information about the communication between Flywire and the external system (for example, the bank or card provider):

Possible values:

| success | The communication with the external system was successful, and a charge will happen. The actual transfer of funds can take a few days depending on the system. |

| failed |

The communication with the external system was successful, but no charge will happen. The external system refused the charge. |

| unknown |

The communication with the external system was not successful. Flywire can't determine if the charge process finished correctly. If this happens, check the payment callbacks (see Payment Status Notifications). If you have received a processed or guaranteed status, the payment has been charged successfully and no further action is required. If after ten minutes you only received the initiated status callback, cancel the payment and create a new payment. Don't try to charge the original payment again while it is still in initiated, you might end up with a duplicated charge. |

{

"payment_reference": "TQQ921794790",

"charge_info": {

"amount": 70000,

"currency": "EUR"

},

"charge_result": {

"status": "success"

}

}If the payment was successfully created but could not be charged, the response contains the payment_reference and information why the charging failed.

When does charging fail?

A failed charge means that the third-party (for example card issuer or bank) refused the charge. This can happen for example when the card was rejected (expired card, insufficient funds etc.) or the bank account number is invalid.

The payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

charge_info object

The payment amount in the payer currency.

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

The payer currency.

Format:

Three-letter ISO 4217 currency code, for example EUR.

charge_result object

The status of the attempted charge. Note that this charge status doesn't mean that funds have successfully been transferred. It gives you information about the communication between Flywire and the external system (for example, the bank or card provider):

Possible values:

| success | The communication with the external system was successful, and a charge will happen. The actual transfer of funds can take a few days depending on the system. |

| failed |

The communication with the external system was successful, but no charge will happen. The external system refused the charge. |

| unknown |

The communication with the external system was not successful. Flywire can't determine if the charge process finished correctly. If this happens, check the payment callbacks (see Payment Status Notifications). If you have received a processed or guaranteed status, the payment has been charged successfully and no further action is required. If after ten minutes you only received the initiated status callback, cancel the payment and create a new payment. Don't try to charge the original payment again while it is still in initiated, you might end up with a duplicated charge. |

errors object

Flywire error code for the error message why charging the payment failed.

The reason why the charge failed that you can share with your payers. You can display this reason to your payer to help them figuring out what went wrong and possibly solve the problem.

There are different reasons depending on what the issue is.

| Issue | Reason returned by the API |

|---|---|

| Configuration or connectivity issues | Your transaction has not been successful, please try again. If the error persists select a different payment method or contact our customer support team. |

| Issues related with bank or card details, like invalid data or refused by the bank | Your transaction has been declined by your bank. Please try inserting correct, valid card/bank account details to complete the payment or contact your bank to resolve the issue. |

| Not enough balance or over amount limit | Your transaction has been declined by your bank. Please try increasing the available balance of your account, use a different card/bank account or contact your bank for further assistance. |

{

"payment_reference": "UUI754118889",

"charge_info": {

"amount": 5000,

"currency": "EUR"

},

"charge_result": {

"status": "failed",

"errors": [

{

"type": 006,

"message": "Your transaction has been declined by your bank.

Please try inserting correct, valid card/bank account

details to complete the payment or contact your bank

to resolve the issue."

}

]

}

}Creating the Payment failed - Resource not found

The payment has not been created.

404 Error

When does this happen?

The payment method token (payment_method_token) or payer ID payor_id is not correct.

What should you do?

-

Check if you used the correct payment method token and payer ID.

-

Check if you used the same payor_id for charging the payment you used for creating the Checkout Session.

{

"type": "https://developers.flywire.com",

"title": "Not Found",

"status": 404,

"detail": "The provided payment_method_token 88b669e924fc46e41fe3 is not valid

or it's not associated to the provided payor_id i_23456789"

}Creating the Payment failed - Missing or invalid parameter

The payment has not been created.

422 Error

When does this happen?

Your request was either missing a parameter or a parameter contained an invalid value.

What should you do?

The error response will tell you which parameter is affected. It could be the parameter itself or the value for the parameter.

-

If there's a missing parameter, check your request if you misspelled the parameter or left it out.

-

If there's an invalid value, check the validation rules for the value. You'll find descriptions of parameters and their allowed values for each request in this documentation.

{

"type": "https://developers.flywire.com",

"title": "Unprocessable entity",

"status": 422,

"detail": "Invalid parameters",

"errors": [

{

"source": "/",

"param": "payor_id",

"type": "missing_param",

"message": "is missing"

}

]

}Creating the Payment failed - Internal Server Error

The payment has not been created.

500 - Internal Server Error

Communication with the API failed.

When does this happen?

The server is unavailable or an unexpected condition was encountered. This can have various reasons, for example:

-

Authentication issues

-

API being unavailable

-

Server time out (the request took longer than 8 secs)

-

Network issues

What should you do?

Check the following and then try again:

-

Authentication

-

Ensure that you are using the right API key and it is correctly implemented in the request.

-

-

Flywire API Status

-

Check the status of the Flywire API: https://status.flywire.com

-

-

Network Connectivity

-

Confirm that your server has a stable internet connection, and no firewall or network issues blocking the connection to the API.

-

{

"type": "https://developers.flywire.com",

"status": "500",

"title": "Internal Server Error"

}Capturing the Funds for a Pre-Authorization Payment

Request

When you capture a Pre-Authorization Payment the card is being charged and Flywire starts processing the payment.

Mandatory emails

There are mandatory emails you need to send to your payer when charging Pre-Authorization Payments, for details see Pre-Authorization Payments: Emails to Your Payer.

How to Resolve the Path Placeholders of the Endpoint

Replace {paymentID} in the endpoint with the payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The payment reference is returned in an API response right after the payment is created .

For existing payments, you have various options to look up a payment reference:

Flywire API: You can find payment references by Getting a List of all Payments.

Callbacks: All payment callbacks contain the payment reference, see Payment Status Notifications.

Parameters for the Request Body

The payment amount in the billing currency.

The billing currency is the currency in which the recipient of the payment is billing their payer. The billing currency depends on the

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

curl https://base-url-placeholder/payments/UUI754118889/captures

-X POST

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"

-d '

{

"amount": 60000

}Response

-

Successful capture attempt

Successful capture attempt -

422 Error

422 Error

The payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

charge_info object

The payment amount in the payer currency.

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

The payer currency.

Format:

Three-letter ISO 4217 currency code, for example EUR.

charge_result object

The status of the attempted communication between Flywire and the external system:

Possible values:

| received |

The external system has received the request and will try to process it. After a successful capture by the external system, you will receive the After an adjustment has been successfully processed by the external system, you will receive the |

| failed |

Sending the request to the external system was not successful. |

{

"payment_reference": "TQQ921794790",

"charge_info": {

"amount": 70000,

"currency": "EUR"

},

"charge_result": {

"status": "received"

}

}Capturing the Pre-Authorization Payment failed - Amount higher than authorized

422 Error

When does this happen?

The amount you tried to capture was higher than the authorized amount.

What should you do?

If you want to capture a higher amount than authorized, you need to adjust the amount before capturing it.

{

"type": "https://developers.flywire.com",

"title": "Unprocessable entity",

"status": 422,

"detail": "Invalid parameters",

"errors": null

}Adjusting or Extending a Pre-Authorization Payment

Request

This endpoint enables you to do two things:

1) Extend the holding period of a Pre-Authorization Payment:

The holding period will be extended to 7 days from today.

How long is the standard holding period?

How long funds can be reserved depends on the card issuer and other circumstances. At the moment, Flywire can reserve the funds for 7 days. The period starts from the day the Pre-Authorization Payment is created.

2) Adjust the amount of a Pre-Authorization Payment during the holding period:

You can change the amount to a higher amount, not to a lower amount, because you simply don't need to adjust the amount for capturing less.

If you capture less, the remaining balance is released back to the cardholder immediately and the payment will be updated to reflect the captured amount.

Adjusting the amount will automatically also extend the holding period to 7 days from today.

Is extending and adjusting always possible?

How to Resolve the Path Placeholders of the Endpoint

Replace {paymentID} in the endpoint with the payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The payment reference is returned in an API response right after the payment is created .

For existing payments, you have various options to look up a payment reference:

Flywire API: You can find payment references by Getting a List of all Payments.

Callbacks: All payment callbacks contain the payment reference, see Payment Status Notifications.

Parameters for the Request Body

The payment amount in the billing currency.

The billing currency is the currency in which the recipient of the payment is billing their payer. The billing currency depends on the

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

For extending the holding period:

Submit the original amount of the payment.

The holding period will be extended to 7 days from today.

For adjusting the amount that is being held:

Submit the new amount.

You can change the amount to a higher amount, not to a lower amount, because you simply don't need to adjust the amount for capturing less.

If you capture less, the remaining balance is released back to the cardholder immediately and the payment will be updated to reflect the captured amount.

Adjusting the amount will automatically also extend the holding period to 7 days from today.

curl https://base-url-placeholder/payments/UUI754118889/authorization_adjustments

-X POST

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"

-d '

{

"amount": 70000

}Response

-

Successful adjustment attempt

Successful adjustment attempt -

422 Error

422 Error

The payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

charge_info object

The payment amount in the payer currency.

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

The payer currency.

Format:

Three-letter ISO 4217 currency code, for example EUR.

charge_result object

The status of the attempted communication between Flywire and the external system:

Possible values:

| received |

The external system has received the request and will try to process it. After a successful capture by the external system, you will receive the After an adjustment has been successfully processed by the external system, you will receive the |

| failed |

Sending the request to the external system was not successful. |

{

"payment_reference": "TQQ921794790",

"charge_info": {

"amount": 70000,

"currency": "EUR"

},

"charge_result": {

"status": "received"

}

}Adjusting the Pre-Authorization Payment failed - Amount is lower than original amount

422 Error

When does this happen?

The amount you tried to adjust to was lower than the originally authorized amount.

You can change the amount to a higher amount, not to a lower amount, because you simply don't need to adjust the amount for capturing less.

If you capture less, the remaining balance is released back to the cardholder immediately and the payment will be updated to reflect the captured amount.

Adjusting the amount will automatically also extend the holding period to 7 days from today.

{

"type": "https://developers.flywire.com",

"title": "Unprocessable entity",

"status": 422,

"detail": "Invalid parameters",

"errors": null

}Marking a Payment as processed

Request

Usually, Flywire takes care of the payment process and captures the funds for you. After capturing the funds, Flywire moves the status of a payment to processed. For 520 Payments, since you are capturing the funds yourself, you have to move the payment into processed yourself.

This is necessary because:

-

It ensures that the payment is following the correct payment workflow.

-

It notifies Flywire that you received the funds.

-

It notifies your payer that you received the funds (if you implemented a system that sends notifications about status changes to your payers).

After a payment is processed by you, you should notify your payer that their payment was processed to avoid duplicate payments. -

It prevents that a payment expires (if payment is not processed it will expire after its due date).

How to Resolve the Path Placeholders of the Endpoint

Replace {paymentID} in the endpoint with the payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The payment reference is returned in an API response right after the payment is created .

For existing payments, you have various options to look up a payment reference:

Flywire API: You can find payment references by Getting a List of all Payments.

Callbacks: All payment callbacks contain the payment reference, see Payment Status Notifications.

Parameters for the Request Body

The external reference.

The external reference helps you to identify a payment, since the Flywire-generated payment reference might not be the way you typically identify payments. With the external reference, you can enter your own identifier, such as an ID or invoice number.

The external reference is included in all status notifications to help you map a payment to a callback notification. (see Payment Status Notifications)

curl https://base-url-placeholder/payments/FWU125675432/process

-X POST

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"

-d '{

"external_reference": "My reference for the payment"

}Response

A 204 response will let you know that the payment has been successfully processed.

If you provided a notifications URL, you'll also receive a notification about the status change of the payment.

204 NO CONTENTCancelling a Payment

Request

Cancelling a payment puts a payment into the  Cancelled status.

Cancelled status.

The payment status  Cancelled means that the payment will not be processed. If Flywire already received the funds, Flywire will return the funds to the payer.

Cancelled means that the payment will not be processed. If Flywire already received the funds, Flywire will return the funds to the payer.

A payment can only be cancelled when it is in status  Initiated or

Initiated or  Failed

Failed

Funds for Pre-Authorization Payments are returned immediately since the amount has only been reserved on the card.

With pre-authorization, you reserve funds on the card for a certain amount of time (the holding period). The funds are reserved but not withdrawn.

The blocked amount returns back to the cardholder's credit:

-

if you don't capture the funds within the holding period

-

if you cancel a Pre-Authorization Payment (immediately after cancelling)

See Payment Status Notifications for information about callbacks for this status.

How to Resolve the Path Placeholders of the Endpoint

Replace {paymentID} in the endpoint with the payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The payment reference is returned in an API response right after the payment is created .

For existing payments, you have various options to look up a payment reference:

Flywire API: You can find payment references by Getting a List of all Payments.

Callbacks: All payment callbacks contain the payment reference, see Payment Status Notifications.

Parameters for the Request Body

No request body needed.

curl https://base-url-placeholder/payments/FWU125675432/cancel

-X POST

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"Response

A 204 response will let you know that the payment has been successfully cancelled.

If you provided a notifications URL, you'll also receive a callback about the status change of the payment.

204 NO CONTENTGetting a List of all Payments

Request

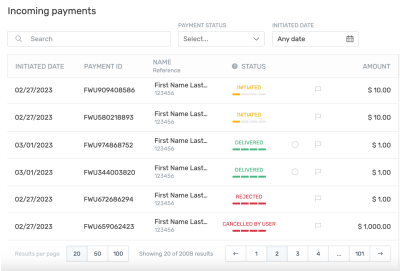

You can use this endpoint to display a list of all payments in a UI.

Which payments will be returned in the list?

The list will contain all payments that have been created by you as a client with your API credentials via the Flywire API .

Don't use the list of payments as a source of truth regarding the payment status. If you want to get immediate updates about a payment's status, use notifications (see Payment Status Notifications).

There can be a latency in fetching this information. Under normal conditions, it takes only minutes to get the latest status of a payment or to show a newly created payment, but it can take much longer depending on technical circumstances.

Example for displaying a list of payments

Each parameter can be used as a column (for example payment reference or status). You can decide which parameters you want to display to help you identify a payment before you get more detailed information about it (see Getting Details about a Payment). Check the response to see which parameters of the payments are returned in the list.

Parameters for the Request Body

No request body needed.

Optional Query Parameters for Filtering

You can filter the list of results by the following parameters:

You can filter the list by one or more (max. 10) specific recipients to only get payments for those recipients back. If you use more than one recipient, divide them by commas (",").

You need to use the recipient ID of the recipient as a value.

The recipient ID identifies the recipient (also called portal). The recipient ID has been assigned by Flywire when the recipient has been set up.

Format:

Either: 3 letters (ABC)

Or: 5 alphanumeric characters, always starting with a letter (ABC1D)

You can filter the list by the status of a payment to only get payments back that are currently in that status. You can only filter by one status at a time.

A payment can have the following statuses and notifications:

| Status | Notification | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

The payment status initiated is the status for all new payments in Flywire. No funds have been received by Flywire at the initiated stage. In everyday usage, a "payment" usually refers to the entire process of making a payment through Flywire. But the term "payment" has a specific meaning in Flywire:

|

||||||||||||||||||||||||

|

|

Only for Pre-Authorization Payments. A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds. Pre-Authorization Payments are only available for same-currency payments, not for FX payments. Example for a Pre-Authorization Payment:

The payment has been authorized and is now in the holding period. How long funds can be reserved depends on the card issuer and other circumstances. At the moment, Flywire can reserve the funds for 7 days. The period starts from the day the Pre-Authorization Payment is created. If you want to hold funds for longer, you can extend the holding period. If you want to release the block on the funds before the holding period ends, you can cancel the Pre-Authorization Payment. The blocked amount returns back to the cardholder's credit:

|

|||||||||||||||||||||||||

|

|

Only for Pre-Authorization Payments. A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds. Pre-Authorization Payments are only available for same-currency payments, not for FX payments. Example for a Pre-Authorization Payment:

The amount that is being held on the card has been adjusted. |

|||||||||||||||||||||||||

|

|

|

The payment status goes from initiated to processed when Flywire has the confirmation that the funds have been received or captured via one of these ways:

For 529 Payments, you have to put a payment into the processed status yourself. After a payment is processed by you, you should notify your payer that their payment was processed to avoid duplicate payments.

|

||||||||||||||||||||||||

|

|

|

The status changes to guaranteed when funds are received by Flywire and all the necessary validations for that payment method and corridor are successful (since Flywire performs a security check on every payment once the funds have been received). At this point, you are guaranteed that Flywire will send you the funds. |

||||||||||||||||||||||||

|

|

|

The status changes from guaranteed to delivered when Flywire sent you the funds in your daily batch disbursement. Payments are updated to delivered at a set time each day. The status delivered is the end stage, the status of a delivered payment can't change. |

||||||||||||||||||||||||

|

|

When a payment is in status This status tells you that a refund has successfully been completed for the payment. |

|||||||||||||||||||||||||

|

|

|

The status failed can only occur for card or direct debit payments. It occurs when there’s an issue to capture the funds. The notification will contain the reason for the failure. |

||||||||||||||||||||||||

|

|

|

The payment status

|

||||||||||||||||||||||||

|

|

|

Only for direct debits payments. The status occurs when you (the client) received the funds from Flywire but Flywire did not receive the funds from your payer's bank account. From a technical side this means:

Note that if the payment fails in an earlier status (processed or guaranteed) the payment will be cancelled instead of reversed. |

You can use this filter to search for values in any of the fields of a recipient.

To narrow down the list of results, you must use this filter in combination with at least one recipient filter. You can use more than one, but maximum ten recipients.

Fields of a recipient (also called a portal) are fields that are specific to that recipient. Depending on how you use Flywire, you might know them under the names dynamic fields, custom fields, or student fields.

Fields are defined when the recipient (also called portal) is set up by Flywire. They are additional fields that the payer has to fill out when they make their payment (additional to the standard payer fields that are the same for all recipients).

For more info about fields see Recipients - Fields.

Possible filters:

-

created_at, created_from, created_to

-

guaranteed_at, guaranteed_from, guaranteed_to

-

delivered_at, delivered_from, delivered_to

-

cancelled_at, cancelled_from, cancelled_to

You can filter the list for a specific date or time span by using the status name plus _at, _from, or _to. Use the format YYYY-MM-DD for the values:

| created_at |

To return only results for a specific date. {endpoint-path}?created_at=2024-01-09 |

| created_from |

To return only results starting from a specific date. {endpoint-path}?created_from=2024-01-09 |

| created_to |

To return only results before a specific date. {endpoint-path}?created_to=2024-01-09 |

| created_from together with created_to |

To return only results between a specific time span. {endpoint-path}?created_from=2024-01-01&created_to=2024-01-09 |

Optional Query Parameters for Pagination

This endpoint supports pagination. If you are not providing any pagination parameters, the response is returned with default pagination settings.

Pagination parameters are added as query parameters with the request in the format {endpoint_path}?page=2&per_page=10

The default setting is:

page=1 (start on page 1)

per_page=10 (display 10 entries per page)

Enables you to access a specific page of the results.

Possible values: Any positive number except zero.

Enables you to define how many results will be included per page.

Possible values: min 1, max 100

curl https://base-url-placeholder/payments

-X GET

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"Response

Pagination Parameters

The total number of items in the full result list, not just of the current page.

The total number of pages available.

The current page of the results.

The maximum number of results to return at one time (on one page).

payments array

The payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The date and time the payment was created.

Timestamps use ISO 8601 format with UTC (YYYY-MM-DDTHH:MM:SSZ, e.g., 2025-03-31T13:21:27Z).

The last part of a timestamp indicates the time zone:

-

Z → Means UTC (Coordinated Universal Time).

Example: 2024-09-20T14:30:00Z = 2:30 PM in UTC.

-

+hh:mm or -hh:mm → Offset from UTC.

Example: 2024-09-20T14:30:00+02:00 = 2:30 PM in a time zone 2 hours ahead of UTC (e.g., Central European Summer Time).

The time and date the payment will expire automatically if no funds were received.

For card payments:

For API integration:

Card payments do not expire. If the charge has been unsuccessful, no other attempts of charging the card will be made. You need to create a new payment to try a new charge attempt.

For other integrations:

Card payments expire usually within 2 business days, when there was no attempted payment or the attempts to capture the funds were unsuccessful.

For Pre-Authorization Payments:

The expiration date is not the holding period length of a Pre-Authorization Payment. For Pre-Authorization Payments, you can disregard this parameter.

How long funds can be reserved depends on the card issuer and other circumstances. At the moment, Flywire can reserve the funds for 7 days. The period starts from the day the Pre-Authorization Payment is created.

A payment expires automatically after a while if no funds are received by Flywire:

-

Bank transfer payments expire usually within 5-8 business days, when no funds have been received by Flywire.

-

Direct debit payments expire usually within 2 business days, when the attempts to capture the funds were unsuccessful.

-

For API integration:

Card payments do not expire. If the charge has been unsuccessful, no other attempts of charging the card will be made. You need to create a new payment to try a new charge attempt.

For other integrations:

Card payments expire usually within 2 business days, when there was no attempted payment or the attempts to capture the funds were unsuccessful.

The current status of the payment.

A payment can have the following statuses and notifications:

| Status | Notification | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

The payment status initiated is the status for all new payments in Flywire. No funds have been received by Flywire at the initiated stage. In everyday usage, a "payment" usually refers to the entire process of making a payment through Flywire. But the term "payment" has a specific meaning in Flywire:

|

||||||||||||||||||||||||

|

|

Only for Pre-Authorization Payments. A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds. Pre-Authorization Payments are only available for same-currency payments, not for FX payments. Example for a Pre-Authorization Payment:

The payment has been authorized and is now in the holding period. How long funds can be reserved depends on the card issuer and other circumstances. At the moment, Flywire can reserve the funds for 7 days. The period starts from the day the Pre-Authorization Payment is created. If you want to hold funds for longer, you can extend the holding period. If you want to release the block on the funds before the holding period ends, you can cancel the Pre-Authorization Payment. The blocked amount returns back to the cardholder's credit:

|

|||||||||||||||||||||||||

|

|

Only for Pre-Authorization Payments. A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds. Pre-Authorization Payments are only available for same-currency payments, not for FX payments. Example for a Pre-Authorization Payment:

The amount that is being held on the card has been adjusted. |

|||||||||||||||||||||||||

|

|

|

The payment status goes from initiated to processed when Flywire has the confirmation that the funds have been received or captured via one of these ways:

For 529 Payments, you have to put a payment into the processed status yourself. After a payment is processed by you, you should notify your payer that their payment was processed to avoid duplicate payments.

|

||||||||||||||||||||||||

|

|

|

The status changes to guaranteed when funds are received by Flywire and all the necessary validations for that payment method and corridor are successful (since Flywire performs a security check on every payment once the funds have been received). At this point, you are guaranteed that Flywire will send you the funds. |

||||||||||||||||||||||||

|

|

|

The status changes from guaranteed to delivered when Flywire sent you the funds in your daily batch disbursement. Payments are updated to delivered at a set time each day. The status delivered is the end stage, the status of a delivered payment can't change. |

||||||||||||||||||||||||

|

|

When a payment is in status This status tells you that a refund has successfully been completed for the payment. |

|||||||||||||||||||||||||

|

|

|

The status failed can only occur for card or direct debit payments. It occurs when there’s an issue to capture the funds. The notification will contain the reason for the failure. |

||||||||||||||||||||||||

|

|

|

The payment status

|

||||||||||||||||||||||||

|

|

|

Only for direct debits payments. The status occurs when you (the client) received the funds from Flywire but Flywire did not receive the funds from your payer's bank account. From a technical side this means:

Note that if the payment fails in an earlier status (processed or guaranteed) the payment will be cancelled instead of reversed. |

The payment amount in the payer currency.

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

Note for payments with adjustments

If there are adjustments for a payment, keep the following in mind:

| amount_to in root | The original payment amount without fees (in the billing currency) |

| amount_to in the adjustments array | The amount of the fees (in the billing currency) |

| amount_to + adjustments.amount_to | The total amount of the payment (in the billing currency) |

| amount_from | The total amount of the payment (amount_to + adjustments.amount_to) (in the payer currency) |

The payer currency.

Format:

Three-letter ISO 4217 currency code, for example EUR.

The payment amount in the billing currency.

The billing currency is the currency in which the recipient of the payment is billing their payer. The billing currency depends on the

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

Note for payments with adjustments

If there are adjustments for a payment, keep the following in mind:

| amount_to in root | The original payment amount without fees (in the billing currency) |

| amount_to in the adjustments array | The amount of the fees (in the billing currency) |

| amount_to + adjustments.amount_to | The total amount of the payment (in the billing currency) |

| amount_from | The total amount of the payment (amount_to + adjustments.amount_to) (in the payer currency) |

The billing currency.

Format:

Three-letter ISO 4217 currency code, for example EUR.

The billing currency is the currency in which the recipient of the payment is billing their payer. The billing currency depends on the

The unique identifier you provided for the payment to help you match the callback to the payment.

For API integrations:

You provided this identifier via the external_reference parameter.

For all other integrations:

You provided this identifier via the callback_id parameter.

Only payments that are in status delivered have a disbursement ID.

The disbursement ID identifies a disbursement.

Format:

Either: ABC2025-12-17

3-letter portal/recipient ID disbursement date YYYY-MM-DD

Or: ABC1D2025-12-17

5-alphanum portal/recipient ID disbursement date YYYY-MM-DD

A disbursement is a bundle of payments that Flywire transfers into

Note if you are using refunds:

Disbursements can also contain refunds if you are using the refund collection method netting.

Netting refers to a method used to simplify transactions. By offsetting the value of multiple payments between you and Flywire into a single net amount, it reduces the number of individual transactions.

Simplified example: You have to pay Flywire $200 because you have to refund money to your payers. At the same time, Flywire has to pay you $500 because you have new payments incoming. Instead of exchanging $200 and $500 separately, netting combines these amounts and you'll receive only $300 from Flywire while Flywire takes no money from you.

Essentials about using netting as a refund collection method

-

Refunds will only be processed when Flywire has received enough funds from new payments to offset them against the pending refunds.

-

This means if the original recipient doesn't have a constant stream of new incoming payments, it can take a while before refunds are processed.

-

This refund collection method is not available by default, you need to set it up together with Flywire. Please contact the Solutions team if you want to use this method.

status_transitions object

The status transitions provide you with a log when a payment went through different statuses. For this reason, the parameters only contain dates if the payment already went through the specific status.

See Payment Status Notifications for details about the statuses.

| Name | Description |

|---|---|

|

guaranteed_at string |

The date and time when the payment was in status guaranteed. |

|

delivered_at string |

The date and time when the payment was in status delivered. |

|

cancelled_at string |

The date and time when the payment was in status cancelled. |

|

authorized_at string |

Only for Pre-Authorization Payments. The date and time when the payment was authorized. Note that the status of an authorized payment is initiated and will stay in this status until the funds are captured. |

The payer ID (payor_id) uniquely identifies a payer.

You provided the payer ID when your created the payment. Usually, you use an ID from another system, like your ERP.

{

"total_entries": 367,

"total_pages": 37,

"page": 1,

"per_page": 10,

"payments": [

{

"payment_id": "TQQ871958420",

"created_at": "2024-04-30T06:37:19Z",

"expiration_date": "2024-05-03T06:37:19Z",

"status": "delivered",

"amount_from": 50000,

"currency_from": "EUR",

"amount_to": 50000,

"currency_to": "EUR",

"external_reference": "My external reference",

"disbursement_id": "TQQ2024-04-30-1714459077",

"status_transitions": {

"guaranteed_at": "2024-04-30T06:37:32Z",

"delivered_at": "2024-04-30T06:37:57Z",

"cancelled_at": null,

"authorized_at": null

},

"payor_id": "My_payer_1"

},

{

...

},

{

"payment_id": "TQQ963354950",

"created_at": "2024-04-30T05:00:10Z",

"expiration_date": "2024-05-04T05:00:09Z",

"status": "guaranteed",

"amount_from": 15000,

"currency_from": "GBP",

"amount_to": 17500,

"currency_to": "EUR",

"external_reference": "My external reference",

"disbursement_id": null,

"status_transitions": {

"guaranteed_at": "2024-05-01T05:00:12Z",

"delivered_at": null,

"cancelled_at": null

},

"payor_id": "My_payer_2"

}

]

}Getting Details about a Payment

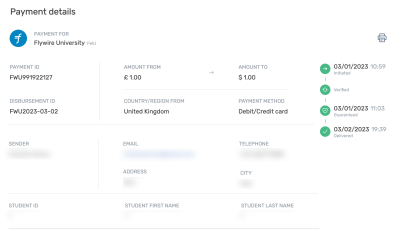

Request

You can use this endpoint to show details about a payment in a UI.

The payment details show real-time information about the payment and can be used as a source of truth. There is no latency like there is for Getting a List of all Payments.

Example for displaying payment details

See Response for which details of the payment are returned so you can display them.

Parameters for the Request Body

No request body needed.

How to Resolve the Path Placeholders of the Endpoint

Replace {paymentID} in the endpoint with the payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The payment reference is returned in an API response right after the payment is created .

For existing payments, you have various options to look up a payment reference:

Flywire API: You can find payment references by Getting a List of all Payments.

Callbacks: All payment callbacks contain the payment reference, see Payment Status Notifications.

curl https://base-url-placeholder/payments/FWU928923284

-X GET

-H "Content-Type: application/json"

-H "X-Authentication-Key: {api_key}"Response

The payment reference.

The payment reference is an ID generated by Flywire to identify a payment.

Format:

Either: ABC123456789

3-letter portal/recipient ID 9 numbers

Or: 1AB12CD452ABC1D

number 8 alphanums number 5-alphanum portal/recipient ID

With the payment reference, the payment can be tracked through the different stages of the payment process.

The payment reference is also important in other situations, for example:

-

When a payer is using bank transfer as payment method, they usually must provide the payment reference when sending the funds.

-

The payment reference helps Flywire to identify the payment if you or your payer needs support.

The date and time the payment was created.

Timestamps use ISO 8601 format with UTC (YYYY-MM-DDTHH:MM:SSZ, e.g., 2025-03-31T13:21:27Z).

The last part of a timestamp indicates the time zone:

-

Z → Means UTC (Coordinated Universal Time).

Example: 2024-09-20T14:30:00Z = 2:30 PM in UTC.

-

+hh:mm or -hh:mm → Offset from UTC.

Example: 2024-09-20T14:30:00+02:00 = 2:30 PM in a time zone 2 hours ahead of UTC (e.g., Central European Summer Time).

The time and date the payment will expire automatically if no funds were received.

For card payments:

For API integration:

Card payments do not expire. If the charge has been unsuccessful, no other attempts of charging the card will be made. You need to create a new payment to try a new charge attempt.

For other integrations:

Card payments expire usually within 2 business days, when there was no attempted payment or the attempts to capture the funds were unsuccessful.

For Pre-Authorization Payments:

The expiration date is not the holding period length of a Pre-Authorization Payment. For Pre-Authorization Payments, you can disregard this parameter.

How long funds can be reserved depends on the card issuer and other circumstances. At the moment, Flywire can reserve the funds for 7 days. The period starts from the day the Pre-Authorization Payment is created.

A payment expires automatically after a while if no funds are received by Flywire:

-

Bank transfer payments expire usually within 5-8 business days, when no funds have been received by Flywire.

-

Direct debit payments expire usually within 2 business days, when the attempts to capture the funds were unsuccessful.

-

For API integration:

Card payments do not expire. If the charge has been unsuccessful, no other attempts of charging the card will be made. You need to create a new payment to try a new charge attempt.

For other integrations:

Card payments expire usually within 2 business days, when there was no attempted payment or the attempts to capture the funds were unsuccessful.

The current status of the payment.

A payment can have the following statuses and notifications:

| Status | Notification | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

The payment status initiated is the status for all new payments in Flywire. No funds have been received by Flywire at the initiated stage. In everyday usage, a "payment" usually refers to the entire process of making a payment through Flywire. But the term "payment" has a specific meaning in Flywire:

|

||||||||||||||||||||||||

|

|

Only for Pre-Authorization Payments. A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds. Pre-Authorization Payments are only available for same-currency payments, not for FX payments. Example for a Pre-Authorization Payment:

The payment has been authorized and is now in the holding period. How long funds can be reserved depends on the card issuer and other circumstances. At the moment, Flywire can reserve the funds for 7 days. The period starts from the day the Pre-Authorization Payment is created. If you want to hold funds for longer, you can extend the holding period. If you want to release the block on the funds before the holding period ends, you can cancel the Pre-Authorization Payment. The blocked amount returns back to the cardholder's credit:

|

|||||||||||||||||||||||||

|

|

Only for Pre-Authorization Payments. A Pre-Authorization Payment temporary reserves the payment amount on a debit or credit card. The purpose of a pre-authorization is to verify that the cardholder has sufficient credit available to cover a transaction and to temporarily set aside that amount until you capture the funds. Pre-Authorization Payments are only available for same-currency payments, not for FX payments. Example for a Pre-Authorization Payment:

The amount that is being held on the card has been adjusted. |

|||||||||||||||||||||||||

|

|

|

The payment status goes from initiated to processed when Flywire has the confirmation that the funds have been received or captured via one of these ways:

For 529 Payments, you have to put a payment into the processed status yourself. After a payment is processed by you, you should notify your payer that their payment was processed to avoid duplicate payments.

|

||||||||||||||||||||||||

|

|

|

The status changes to guaranteed when funds are received by Flywire and all the necessary validations for that payment method and corridor are successful (since Flywire performs a security check on every payment once the funds have been received). At this point, you are guaranteed that Flywire will send you the funds. |

||||||||||||||||||||||||

|

|

|

The status changes from guaranteed to delivered when Flywire sent you the funds in your daily batch disbursement. Payments are updated to delivered at a set time each day. The status delivered is the end stage, the status of a delivered payment can't change. |

||||||||||||||||||||||||

|

|

When a payment is in status This status tells you that a refund has successfully been completed for the payment. |

|||||||||||||||||||||||||

|

|

|

The status failed can only occur for card or direct debit payments. It occurs when there’s an issue to capture the funds. The notification will contain the reason for the failure. |

||||||||||||||||||||||||

|

|

|

The payment status

|

||||||||||||||||||||||||

|

|

|

Only for direct debits payments. The status occurs when you (the client) received the funds from Flywire but Flywire did not receive the funds from your payer's bank account. From a technical side this means:

Note that if the payment fails in an earlier status (processed or guaranteed) the payment will be cancelled instead of reversed. |

Details about the payment status.

The payment statuses trigger callback notifications (see Payment Status Notifications). For each status, there can be more detailed info (the payment status detail) that doesn't trigger a callback but can give you more insight about the current state of the payment. The status details are like sub-statuses for the payment status. While the payment status is meant to be exposed to your payers so they can track their payment too, the status detail is meant to be as an internal information for you.

| Payment status (for callbacks) | Possible payment status details |

| initiated | initiated, processing |

| processed | verification |

| guaranteed | on_hold |

| reversed | reversed |

status_transitions object

The status transitions provide you with a log when a payment went through different statuses. For this reason, the parameters only contain dates if the payment already went through the specific status.

See Payment Status Notifications for details about the statuses.

| Name | Description |

|---|---|

|

guaranteed_at string |

The date and time when the payment was in status guaranteed. |

|

delivered_at string |

The date and time when the payment was in status delivered. |

|

cancelled_at string |

The date and time when the payment was in status cancelled. |

|

authorized_at string |

Only for Pre-Authorization Payments. The date and time when the payment was authorized. Note that the status of an authorized payment is initiated and will stay in this status until the funds are captured. |

The payment amount in the payer currency.

The amount is specified in the smallest unit of the currency, called subunits. For example, in USD, the subunit is cents, and 100 cents equal 1 USD. So, an amount of 12025 (cents) is equivalent to 120.25 USD.

Note that the subunit-to-unit ratio varies by currency, it is not always 100. See Currencies for the subunits of each currency.

Note for payments with adjustments

If there are adjustments for a payment, keep the following in mind:

| amount_to in root | The original payment amount without fees (in the billing currency) |